These days, it feels like everyone’s talking about Bitcoin and Ethereum ETFs (exchange-traded funds). And while it’s great to see more people getting interested in crypto, it’s even better when you understand how that interest works, how it can move prices, and—most importantly—how it might shape your own trading approach. In this article, we’ll break down what crypto ETFs are all about and share some tips on how you can make the most of the signals and information surrounding them.

TLDR:

- ETFs make crypto investing accessible: they remove technical barriers, allowing anyone to invest in Bitcoin or Ethereum easily.

- Institutional involvement builds trust: big players entering through ETFs legitimize and stabilize the crypto market.

- Demand drives price changes: ETF purchases create upward pressure on prices, especially for scarce assets like Bitcoin.

- Market sentiment becomes clearer: ETF inflows and outflows act as indicators of bullish or bearish trends.

- ETF tracking is easier with market intelligence platforms: automating ETF analysis with platforms like Jellydator ensures you stay informed about key shifts without constant monitoring.

Quick Introduction to ETFs

Before we dive into crypto ETFs, let’s take a moment to establish—or refresh—what ETFs are all about. Think of ETFs as investment bundles or packages. Instead of purchasing each asset individually, you get a ready-made collection designed around specific strategies. Some of these bundles include hundreds of assets, like stocks from 500 different companies, while others zero in on a single focus item, such as Bitcoin, gold, or the Euro. They’re essentially a convenient way to invest in a diversified or targeted portfolio without the hassle of picking each component yourself.

How they work in practice:

- You buy shares through stock brokerage apps, just like purchasing Disney or Netflix stock.

- Your investment automatically spreads across all items in that ETF’s package.

- Prices update live during market hours.

Bitcoin and Ethereum ETFs

Now that we’ve covered what ETFs are, let’s look at how they apply to the world of crypto. Imagine being able to invest in Bitcoin or Ethereum as effortlessly as buying a stock—that’s exactly what crypto ETFs bring to the table. These funds allow you to speculate on cryptocurrency prices without dealing with the challenges of managing digital wallets, navigating security risks, or using complicated exchanges. Here’s how they work:

Spot ETFs: The Direct Approach

These funds buy and hold real Bitcoin or Ethereum. For example, if you

invest $100 in a Bitcoin spot ETF, the fund uses your money to purchase

actual BTC and stores it in heavily guarded digital vaults. Prices closely

track the crypto’s live market value, making it a transparent option for

casual investors. Popular picks include BlackRock’s iShares Bitcoin Trust

(IBIT) and Fidelity’s Ethereum ETF.

Futures ETFs: The Indirect Route

Instead of holding crypto, these ETFs use contracts tied to future prices.

They’re easier to regulate but can sometimes lag behind real-time price

swings. Think of it like betting on the weather forecast instead of

stepping outside.

Why They Are Popular:

- Easy access: trade them on apps like Robinhood or Schwab, just like stocks.

- Built-in security: regulators like the SEC monitor these funds, reducing risks like hacking or fraud.

- Diverse opportunities: Bitcoin ETFs suit those seeking a “digital gold” safe haven, while Ethereum ETFs connect to trends like NFT art, metaverse gaming, and automated finance tools.

Fun Fact: Even retirement funds and big institutions are jumping in. In 2024, Wisconsin’s pension fund invested over $160 million in Bitcoin ETFs!

Should You Buy Bitcoin/Ethereum Directly or via an ETF?

When you buy Bitcoin or Ethereum directly, you own the actual cryptocurrency, much like holding cash in a digital wallet. This method unlocks the full potential of blockchain technology—letting you participate in decentralized apps (DeFi), earn rewards through staking (for Ethereum), or spend crypto where accepted.

Pros of direct ownership:

- Full control: no third parties dictate how you use your crypto.

- Utility: engage with staking, DeFi, or real-world transactions.

- No recurring fees: pay only transaction costs, not management fees.

Cons of direct ownership:

- Security risks: lose your wallet’s password or private keys, and your funds disappear forever.

- Steep learning curve: requires understanding wallets, exchanges, and scam avoidance.

- Regulatory uncertainty: governments may impose restrictions (for instance, mining bans, transaction limits) that directly impact your holdings or access.

While direct ownership offers freedom, it demands technical confidence. Beginners often find managing wallets overwhelming, but tech-savvy users value the independence.

For a simpler approach, crypto ETFs let you invest in Bitcoin or Ethereum indirectly through shares of a fund that tracks crypto prices. These trade like stocks on platforms such as Robinhood or Fidelity, handling security and storage for you.

Pros of ETFs:

- Beginner-friendly: no wallets, keys, or tech expertise required.

- Regulated security: funds are audited and held by trusted institutions.

- Simpler taxes: ETFs often automate tax documentation.

Cons of ETFs:

- Ongoing costs: fees (0.5%–2% annually) eat into long-term gains.

- Limited use: no staking, spending, or DeFi interactions.

- Tracking gaps: prices might lag slightly behind real crypto markets.

ETFs remove complexity but sacrifice flexibility. They’re ideal for passive, long-term investors who prioritize stability over hands-on involvement.

So, which suits you? Ask yourself:

- Do you want to use crypto (DeFi, staking) or just invest?

- Are you comfortable securing digital assets? If not, ETFs reduce risk.

- What’s your risk tolerance? Direct ownership offers higher rewards but sharper volatility.

For example, a retiree might prefer ETFs for simplicity, while a younger investor chasing DeFi opportunities would opt for direct ownership. Both paths have trade-offs—align your choice with your goals and comfort level.

Can You Buy Crypto ETFs on Crypto Exchanges Like Binance or Coinbase?

Bitcoin and Ethereum ETFs are traded on traditional stock exchanges like the Nasdaq or NYSE, not on cryptocurrency platforms such as Binance or Coinbase. To invest in these ETFs, you’ll need a licensed brokerage account through services like Fidelity, Robinhood, or Charles Schwab—where they’re bought and sold like regular stocks. These ETFs are regulated by financial authorities like the SEC, offering a familiar investment structure without direct crypto ownership. In contrast, platforms like Binance and Coinbase specialize in direct cryptocurrency purchases, where you trade actual Bitcoin or Ethereum, and the exchange handles storage through integrated custodial wallets.

How Are Crypto ETFs Useful If You Don’t Invest in Them?

Even if you never buy a Bitcoin or Ethereum ETF, their existence can still impact the crypto market in ways that matter to everyone. Here’s why:

- They Act as a Demand Meter

Crypto ETFs act like a live scoreboard for investor interest. When ETFs attract more buyers, the funds must purchase Bitcoin or Ethereum to back their shares. This creates steady demand, which can push prices upward. For Bitcoin, which has a fixed supply (only 21 million will ever exist), ETF buying can outpace new coins entering the market. - They Signal Market Confidence

Major institutions like BlackRock offering ETFs signal that cryptocurrencies are becoming mainstream. This “stamp of approval” can boost overall confidence in Bitcoin and Ethereum, attracting more users, businesses, and even governments to adopt or support crypto. - They Simplify Market Trends

You don’t need to track complex crypto charts to gauge sentiment. Rising ETF inflows (money pouring into these funds) often hint at bullish trends, while outflows might signal caution. For example, Bitcoin hit record highs in 2024 after ETF buying sprees. - They Highlight Scarcity

Bitcoin’s supply grows very slowly (new coins are released at a predictable rate). If ETFs keep buying faster than new coins are created, prices tend to rise—a basic supply-demand imbalance anyone can grasp.

Think of it like this:

If concert tickets sell out in minutes, you know the band is wildly

popular—even if you don’t attend. Similarly, surging ETF demand shows

crypto’s growing appeal, which can lead to higher prices or broader adoption.

This makes ETFs a window into the crypto world’s future, whether you’re investing or just watching.

Tracking Crypto ETF Holding Changes

Keeping an eye on Bitcoin and Ethereum ETF holdings can give you a significant edge. Fluctuations in these numbers often reflect broader market trends or institutional moves, offering you the chance to spot opportunities before they become obvious to others. But let’s face it—manually tracking these shifts can feel like a full-time job, and most of us don’t have the luxury of sitting in front of a brokerage platform all day.

Sure, you could still go the manual route: refreshing charts and crunching numbers whenever you have a spare moment. It works, but it’s time-consuming and not exactly practical if you’re juggling other priorities like work, family, or managing a diverse portfolio. That’s where market intelligence platforms like Jellydator come in to make life easier.

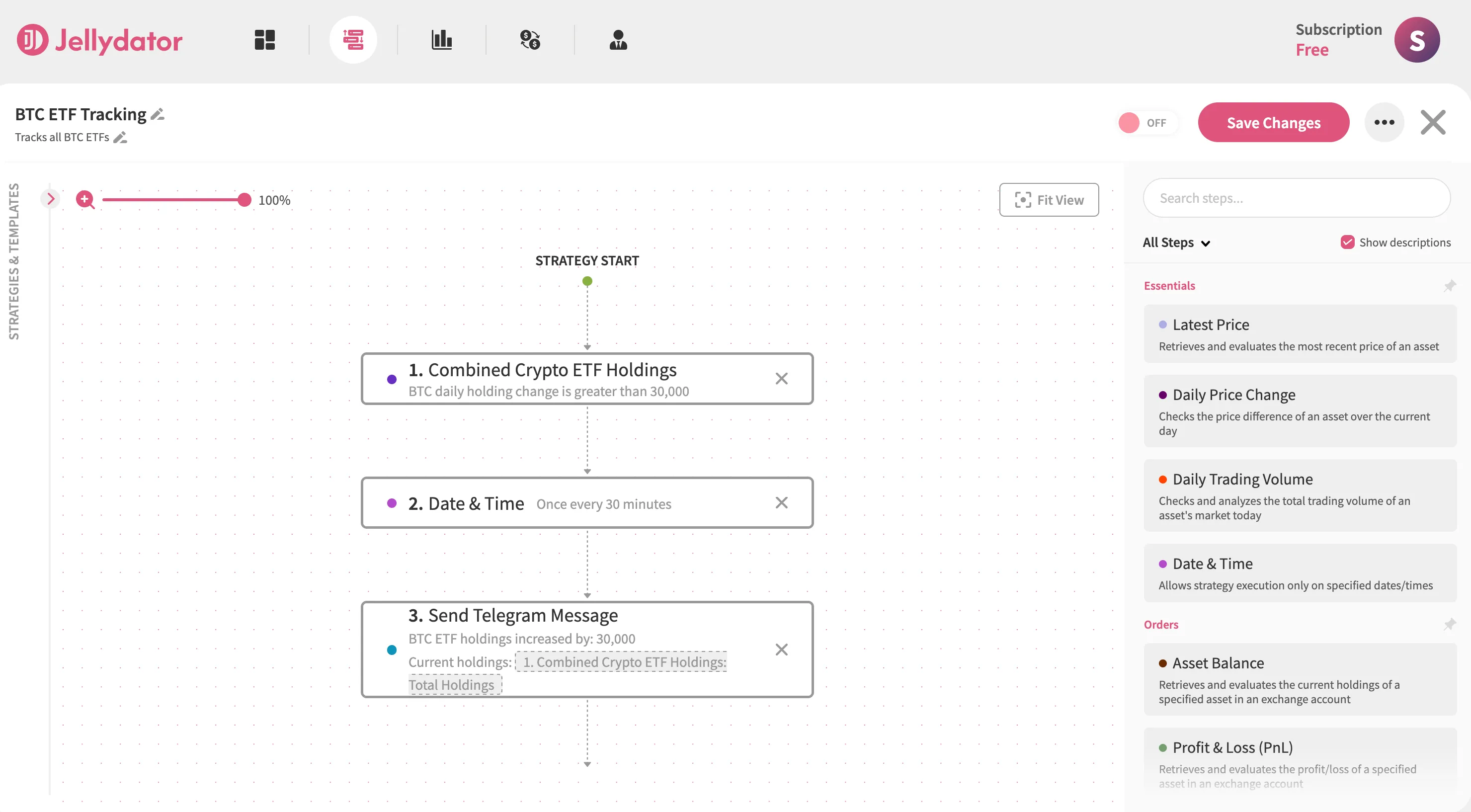

With Jellydator, you can automate the ETF tracking process and receive notifications when key updates occur—no coding or technical expertise required. Here’s how to set up a simple Jellydator strategy that does exactly that:

- Add the Combined Crypto ETF Holdings step, select Bitcoin (BTC), and set your growth target (for example, 30,000 BTC).

- Use the Date & Time step to control how often you get notified—for instance, no more than once every 30 minutes.

- Add a notification step to specify how you’d like to receive updates (for example, via Telegram).

- Save your strategy and activate it.

Once your strategy is live, Jellydator will handle the heavy lifting for you—tracking ETF holdings and notifying you whenever your conditions are met. This way, you can stay informed without constantly monitoring data yourself. It’s a practical solution that lets you focus on other aspects of your life while staying ahead in the fast-moving world of crypto ETFs.

Conclusion

Crypto ETFs are transforming the crypto market by bridging the gap between traditional finance and digital assets. They simplify investing, attract institutional players, and boost legitimacy for cryptocurrencies. This increased demand doesn’t just stabilize the market—it often signals price movements and broader adoption trends. By tracking ETF activity, you gain valuable insights into these shifts, helping you stay ahead of the curve and seize opportunities early.