Dollar-cost averaging (DCA) has emerged as one of the most popular investment strategies in the cryptocurrency market, particularly appealing to beginners and risk-conscious investors. Its approach offers a structured way to navigate the notoriously volatile crypto landscape while building positions in digital assets over time. But even a strategy as simple as DCA has its quirks and challenges. In this article, we’ll break down the key things you need to know about DCA and share some easy tips to help you make it work like a charm.

TLDR:

- Dollar-cost averaging (DCA) involves regularly investing a fixed amount into an asset to reduce the impact of market volatility and achieve a better average price.

- A 2024 Kraken survey showed 59% of crypto investors use DCA, with high-income investors favoring it for its simplicity and risk management.

- Platforms like Binance, Kraken, and Coinbase offer recurring buy options for easy DCA but come with limited flexibility.

- Tools like Jellydator enhance DCA with features like custom schedules, price and market sentiment triggers, and dynamic amount adjustments to match individual goals.

What is Dollar-Cost Averaging?

Dollar-cost averaging is a strategy where you invest a set amount of money into an asset on a regular schedule, no matter what the current price is. Instead of trying to predict the perfect moment to buy, DCA spreads your investments over time, making it easier to manage market ups and downs. The idea is simple: by investing consistently, you end up buying more cryptocurrency when prices drop and less when they rise. Over time, this can lead to a better average entry price compared to putting all your money in at once.

Why DCA Has Become the Preferred Strategy for Crypto Investors

Recent data strongly supports the growing popularity of DCA among cryptocurrency investors. According to Kraken’s 2024 survey of 1,109 crypto investors, 59% identified dollar-cost averaging as their primary investment strategy, while an impressive 83.53% reported using it at least once in their crypto activities.

The strategy has also gained significant traction among high-income investors. The survey revealed that 77.70% of individuals earning over $200,000 annually rely on DCA as their main approach. This shows that even seasoned investors with substantial resources value the simplicity and effectiveness of DCA in navigating market volatility.

When asked about its advantages, 46.13% of respondents pointed to DCA’s ability to mitigate the impact of market volatility as its biggest benefit. Additionally, 33% emphasized how it helps establish consistent investment habits, making it a powerful tool for staying disciplined in the unpredictable world of crypto trading.

Using DCA Through Exchange “Recurring Buy” Features

The easiest way to start dollar-cost averaging in crypto is by using the “recurring buy” features available on most major exchanges. These tools automate the process, allowing you to schedule regular purchases without the hassle of manually placing orders each time. Here’s a look at how some popular platforms make it simple to set up recurring buys:

- Binance’s Recurring Buy: supports over 45 local currencies and lets you choose daily, weekly, bi-weekly, or monthly purchase schedules.

- Kraken’s Recurring Orders: offers flexible recurring orders that allow you to schedule daily, weekly, bi-weekly, or monthly purchases.

- Coinbase’s Recurring Buy: enables recurring buys with options for weekly, bi-monthly (1st and 15th of the month), or monthly schedules.

- Revolut’s Crypto Recurring Buy: allows daily, weekly, or monthly automated purchases directly through its app.

Limitations of Recurring Buy Features on Exchanges

Despite their convenience, the recurring buy features available on most exchanges have significant limitations that restrict their flexibility and sophistication. These constraints can frustrate more advanced investors seeking greater control over their DCA strategy.

For instance, the frequency options offered are often limited to basic intervals—daily, weekly, bi-weekly, or monthly—with little room for customization. This rigidity makes it difficult for users to implement more nuanced timing strategies that align with their unique investment goals.

Another common limitation is that many platforms do not allow modifications to recurring orders once established. As stated in Coinbase’s help documentation, “it’s not possible to alter the amount or buying frequency after you’ve set it”. Instead, users must cancel existing orders and create new ones, adding unnecessary friction to the process.

Most critically, standard recurring buy features typically lack the ability to incorporate conditional logic or responsive adjustments based on market conditions. For example, users generally cannot:

- Set purchases to trigger only when prices drop below certain thresholds (with limited exceptions like Kraken’s “if below a target price” option).

- Implement variable purchase amounts based on market trends.

- Incorporate technical indicators or market sentiment data to adjust purchase timing.

Breaking Free from Exchange Limits

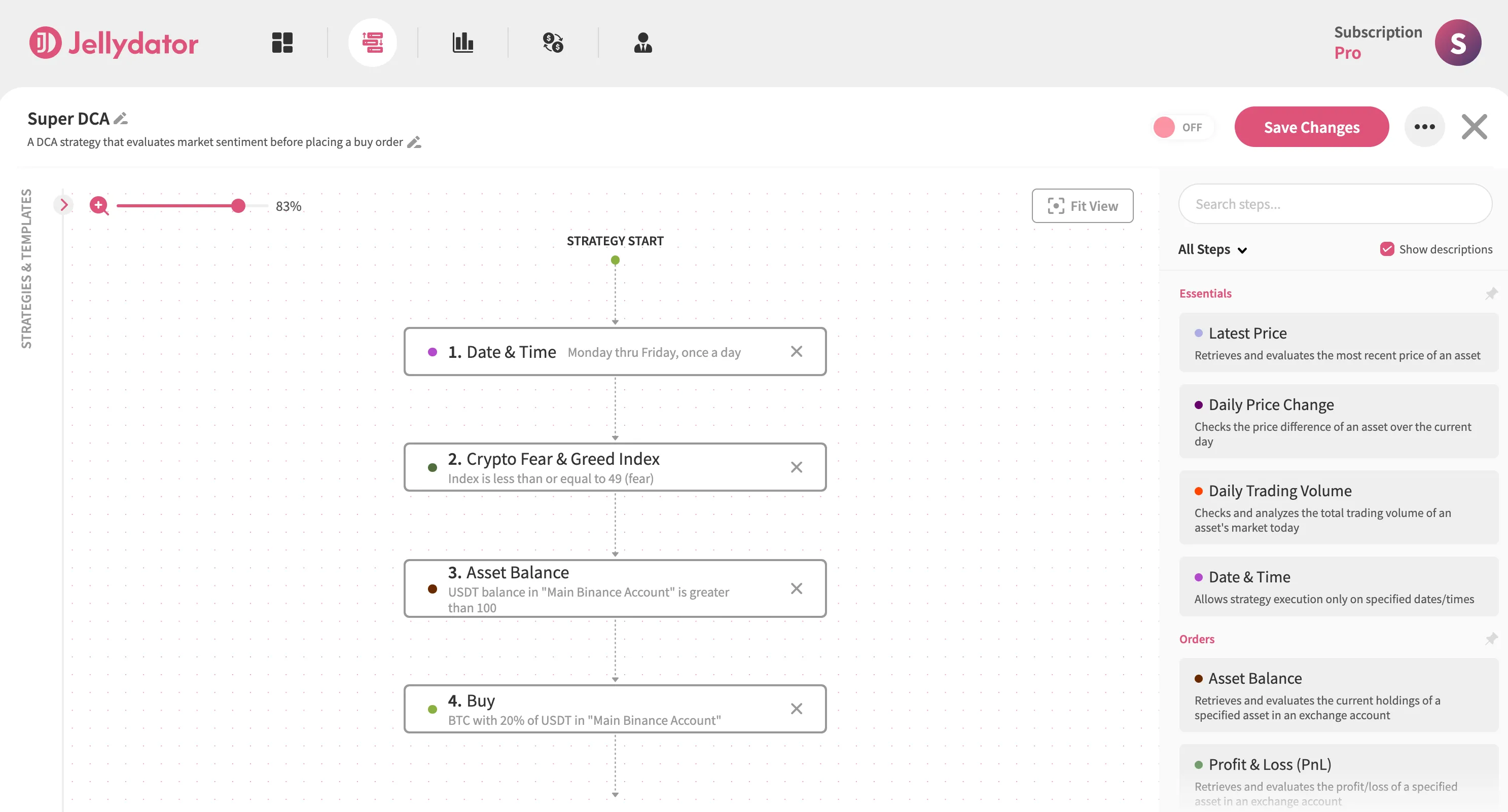

If the limitations of standard “recurring buy” options leave you frustrated, there are platforms that offer more advanced solutions. For example, Jellydator provides tools that let you design a DCA strategy tailored to your needs using its simple drag-and-drop editor. Here’s what you can do with it:

- Create custom time schedules, including multiple overlapping ones.

- Add checks based on price, technical indicators, market sentiment, or trends.

- Adjust buy orders dynamically depending on your portfolio size.

With Jellydator, you’re not stuck with one-size-fits-all options that could lead to unintended costs. Instead, its editor makes it easy to build strategies that adapt to your goals and imagination.

Conclusion

Dollar-cost averaging is a reliable strategy for cryptocurrency investors looking to grow their portfolios while keeping risk in check. Its popularity, especially among high-income investors, underscores its effectiveness in handling the unpredictable nature of the crypto market. However, while exchange-based recurring buy features offer a simple way to get started with DCA, their limitations make a strong case for exploring more flexible solutions, such as automated trading platforms like Jellydator.