Automated crypto trading can be thrilling, but creating strategies with unfamiliar tools requires caution. Even though the Jellydator editor is designed to be intuitive, testing your strategies before risking real money is essential. To support this, Jellydator provides a practical and risk-free solution: paper exchanges.

What Is a Paper Exchange?

A paper exchange simulates real trading environments, such as Binance or Coinbase, but uses artificial funds instead of your actual money. This allows you to execute trades and test strategies without financial risk. The prices and market conditions reflect real-time data, giving you a realistic testing ground for your ideas.

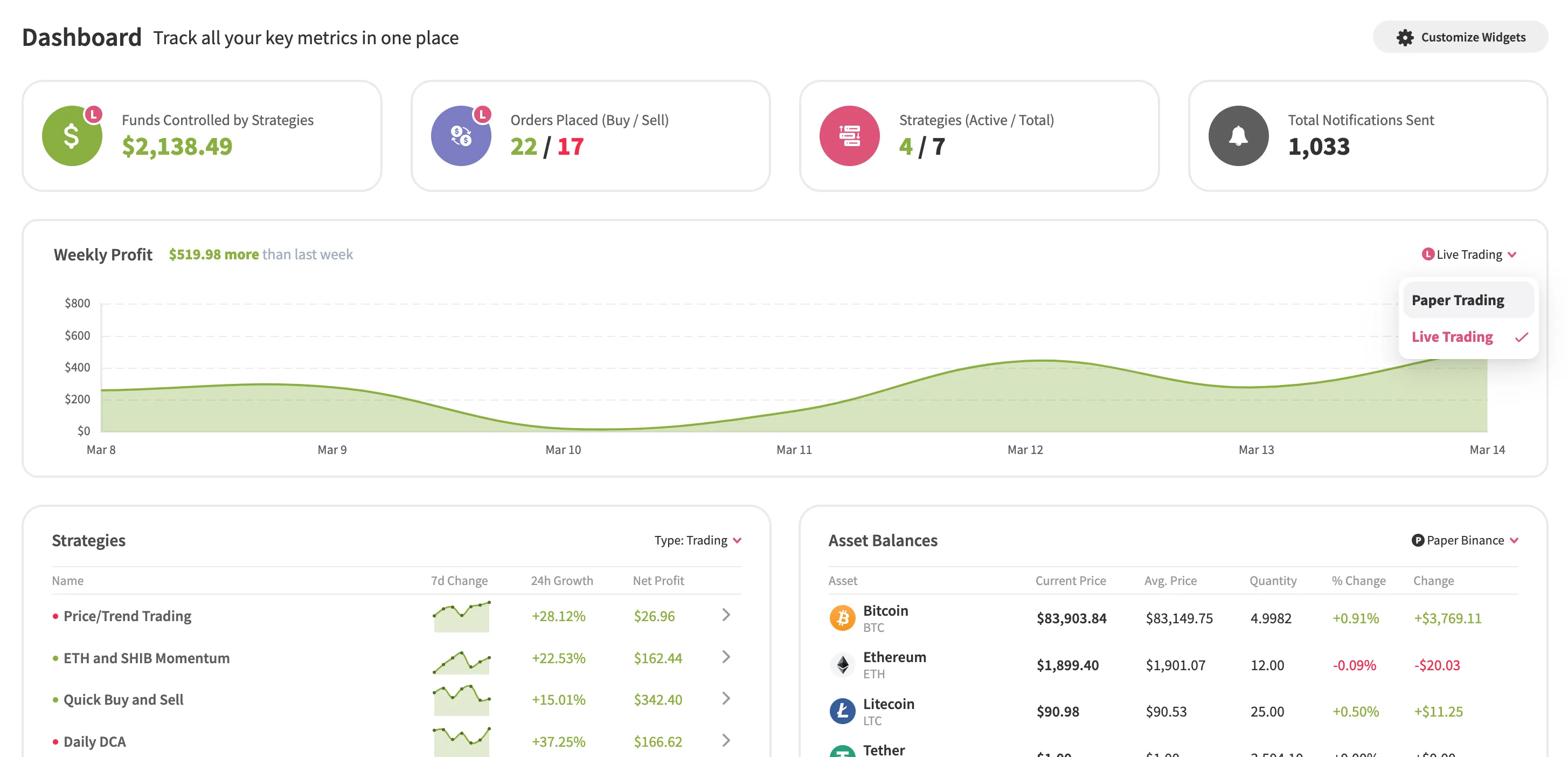

When using Jellydator’s paper exchange feature, your fake trading data is kept separate from your live trading data. This ensures clarity and prevents confusion. Additionally, Jellydator’s dashboard lets you seamlessly switch between live and paper trading statistics, making it easy to assess the performance of your strategy in a simulated environment before transitioning to live markets.

Why Use Paper Exchanges?

Here are some key benefits of paper exchanges:

- Risk-free testing: experiment with different strategies without the fear of losing money.

- Confidence building: practice managing trades and handling market fluctuations in a safe environment.

- Skill development: enhance your decision-making and trade management skills through hands-on practice.

How to Set Up a Paper Exchange?

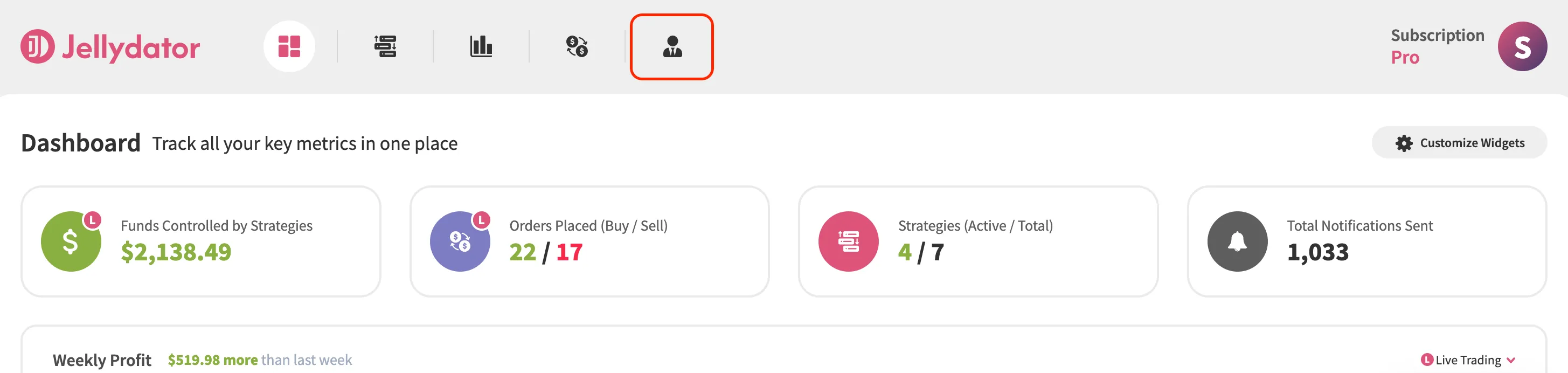

1. Go to the Account Page

Begin by navigating to the Account page on the Jellydator website.

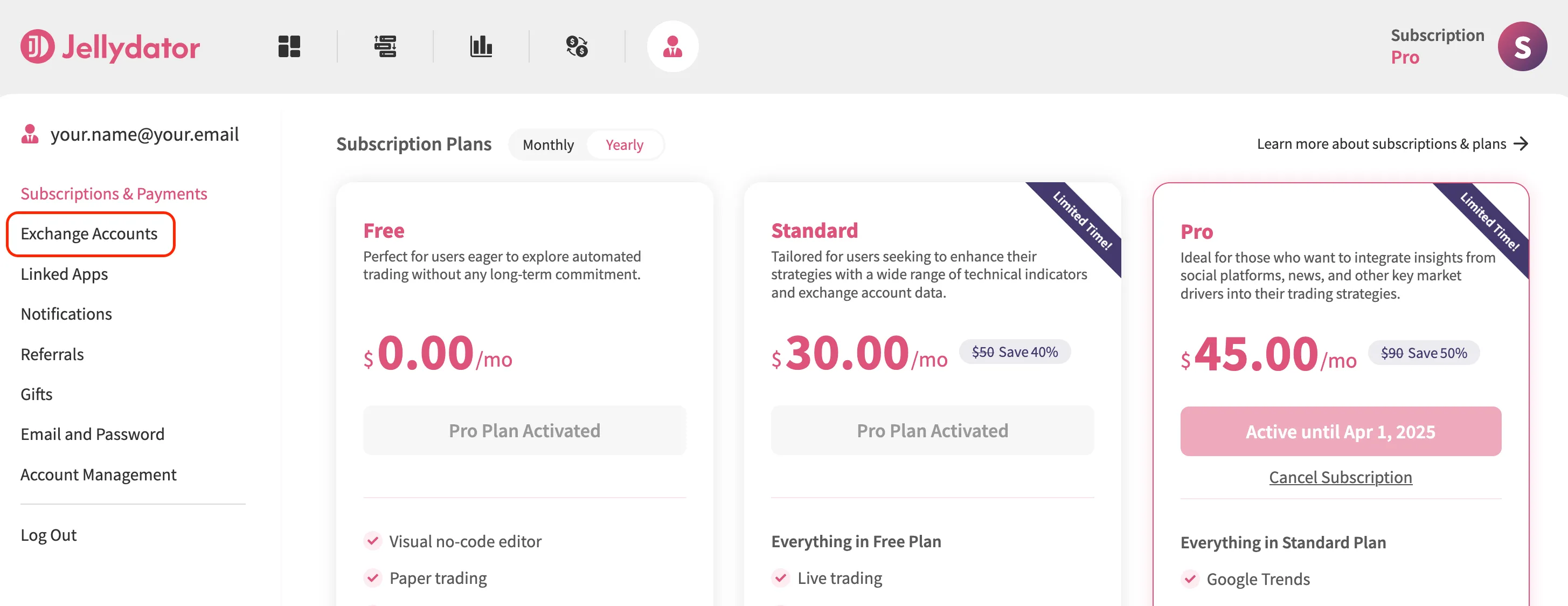

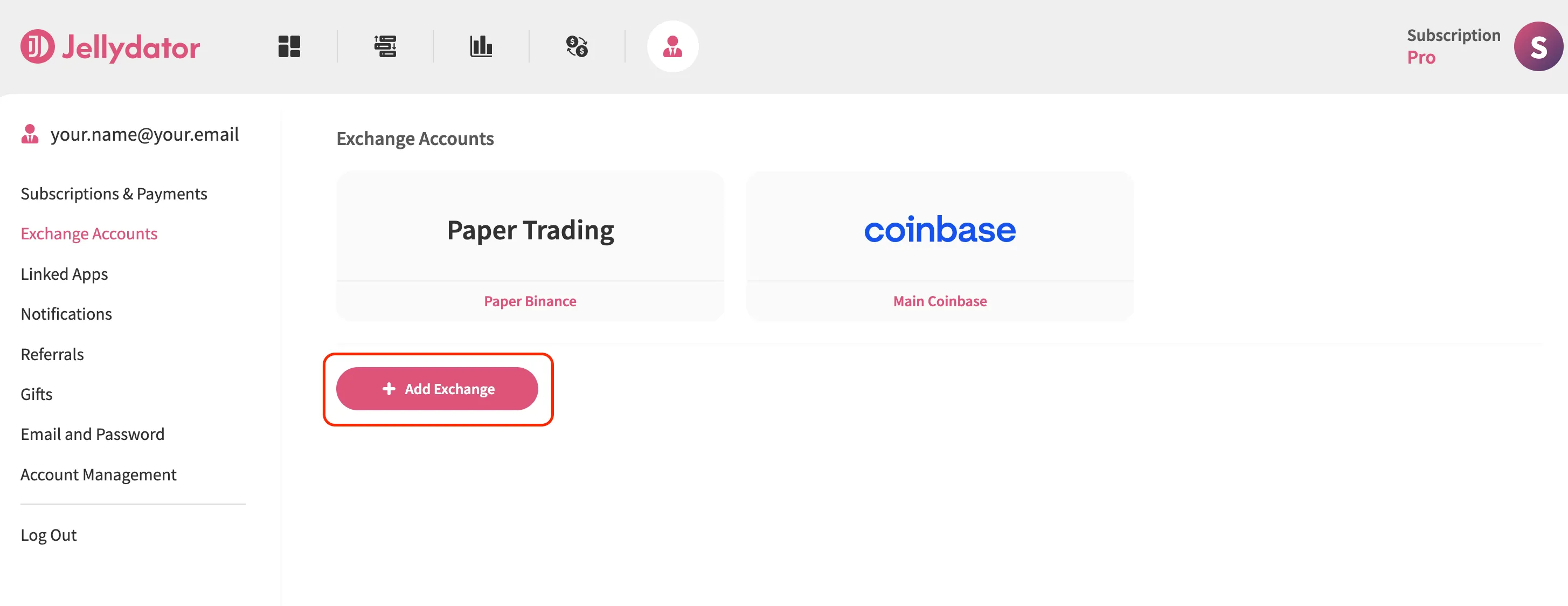

2. Open the Exchange Accounts Page

Once on the account page, locate and open the Exchange Accounts sub-page. This is where you’ll manage both live and paper exchange accounts.

3. Click Add Exchange

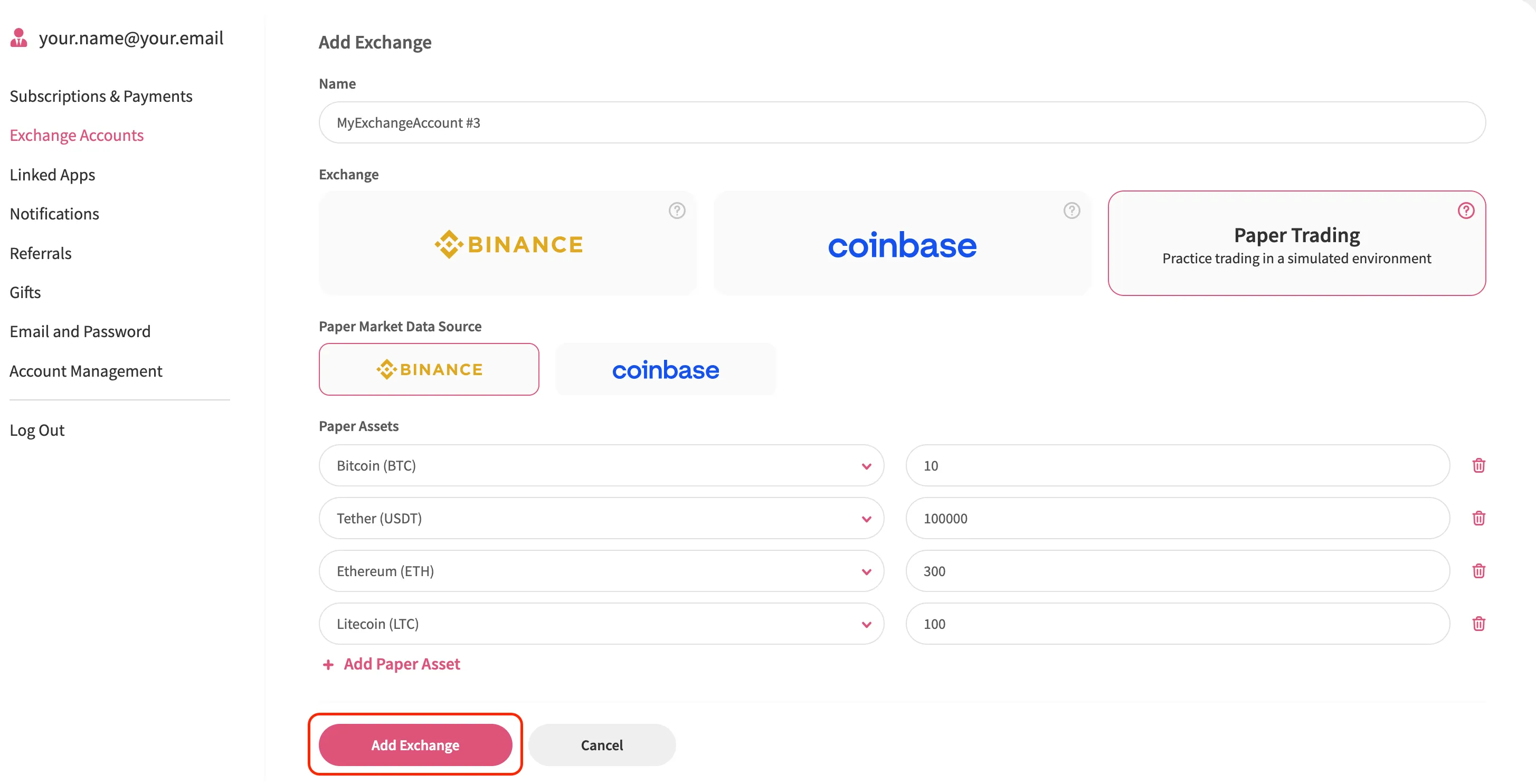

Click on the Add Exchange button to create a new exchange account. This step is optional if you don’t have any other exchange accounts.

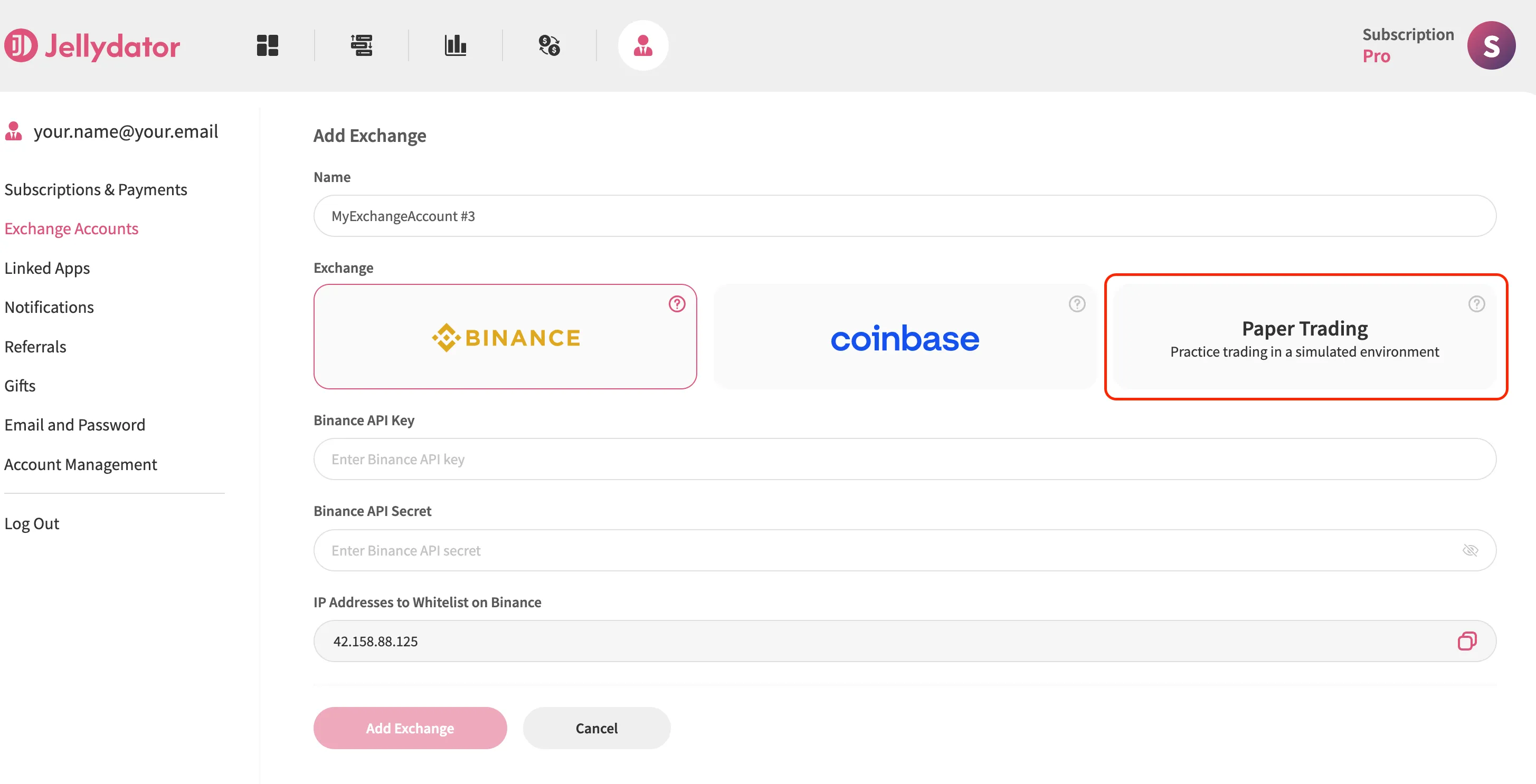

4. Select Paper Trading

From the list of exchange types, choose Paper Trading. This option sets up a simulated trading environment.

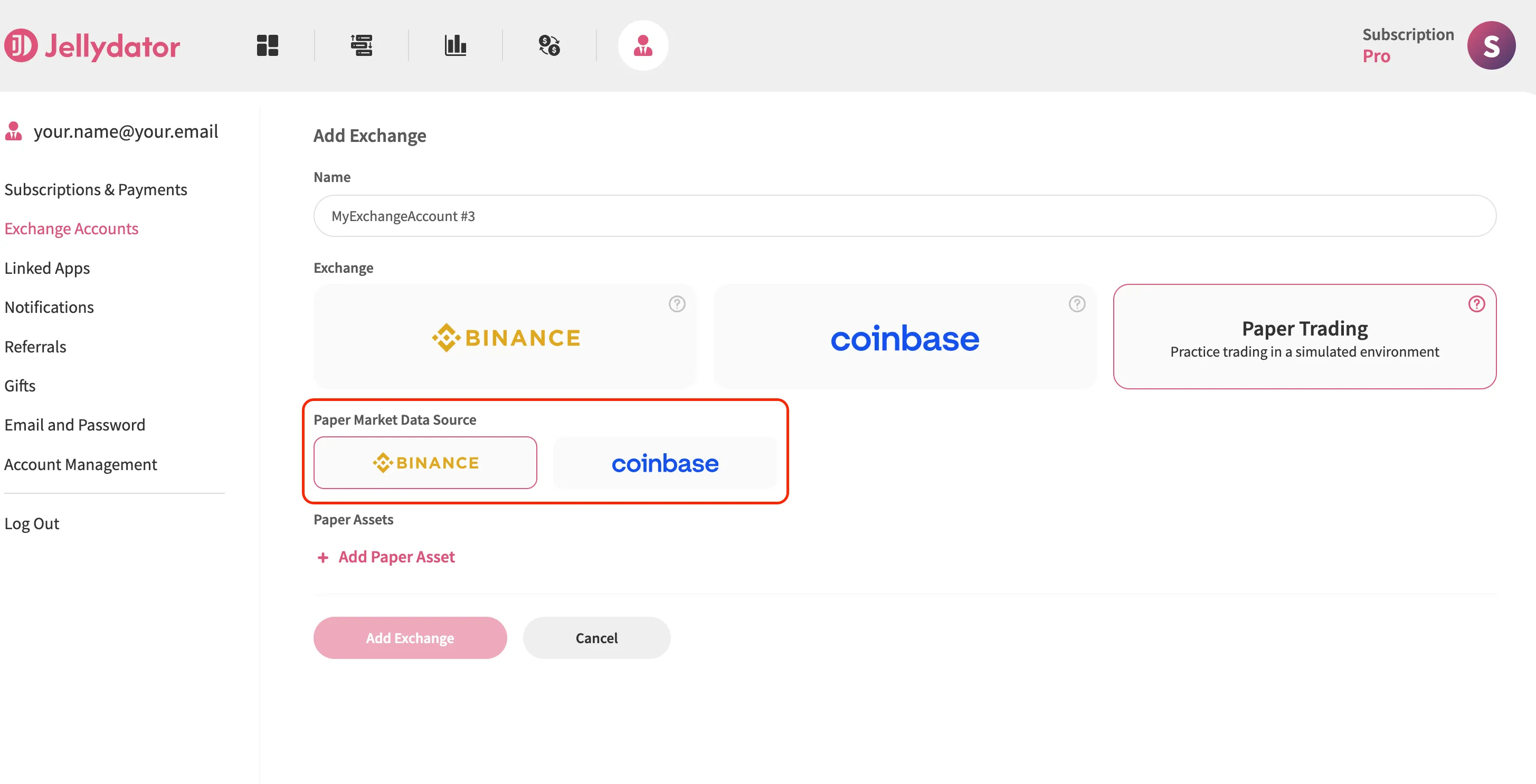

5. Select a Market Data Source Exchange

Choose an exchange (e.g., Binance or Coinbase) as your market data source. This ensures that your paper exchange uses real-time prices and market data for accurate testing. Don’t worry—your real funds on this source exchange will remain untouched.

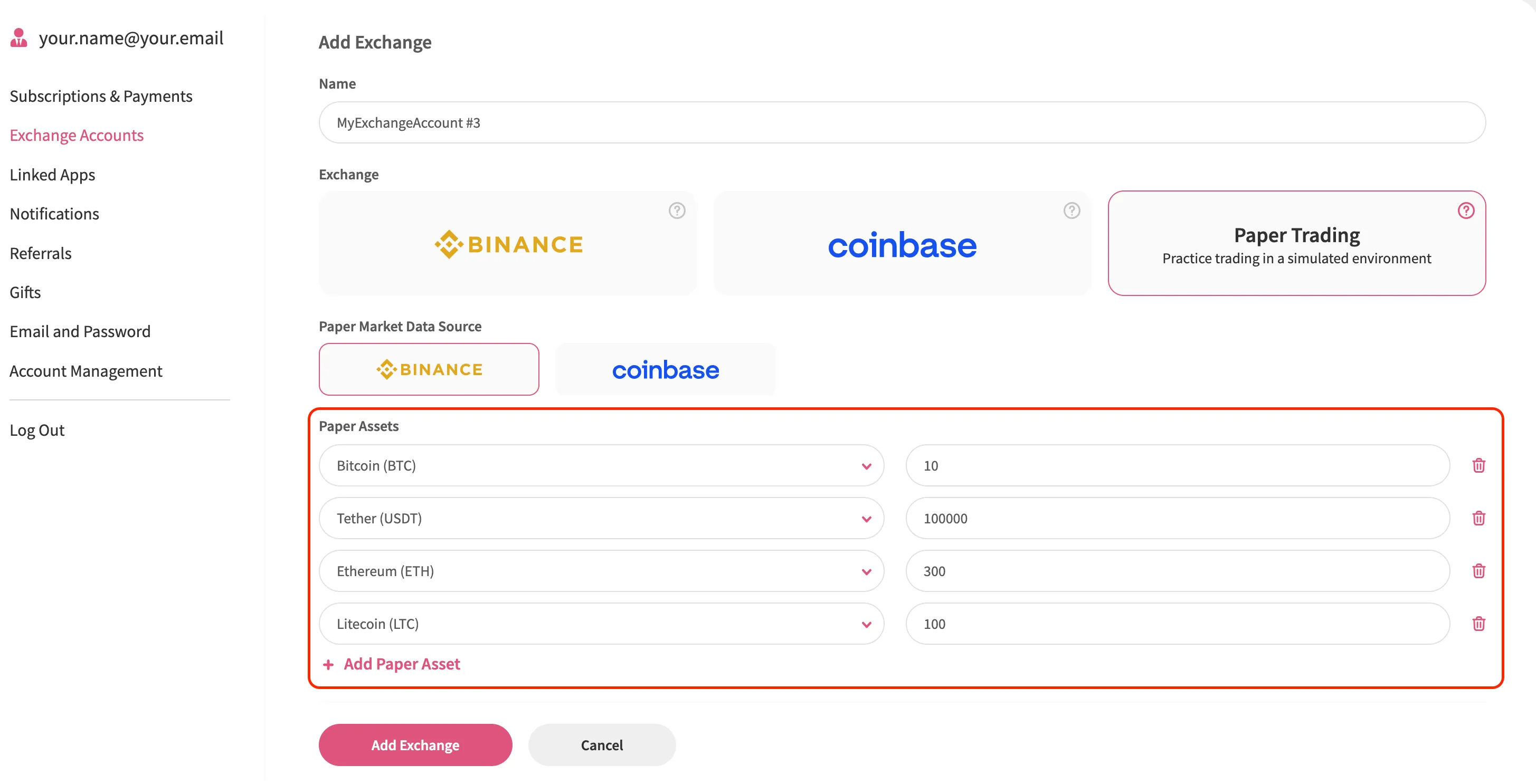

6. Add Assets You Want to Trade

Define the artificial assets and funds you want to use for testing. This step allows you to simulate trades with specific cryptocurrencies and amounts.

7. Click Add Exchange Again

After configuring your paper exchange, click Add Exchange to finalize the setup.

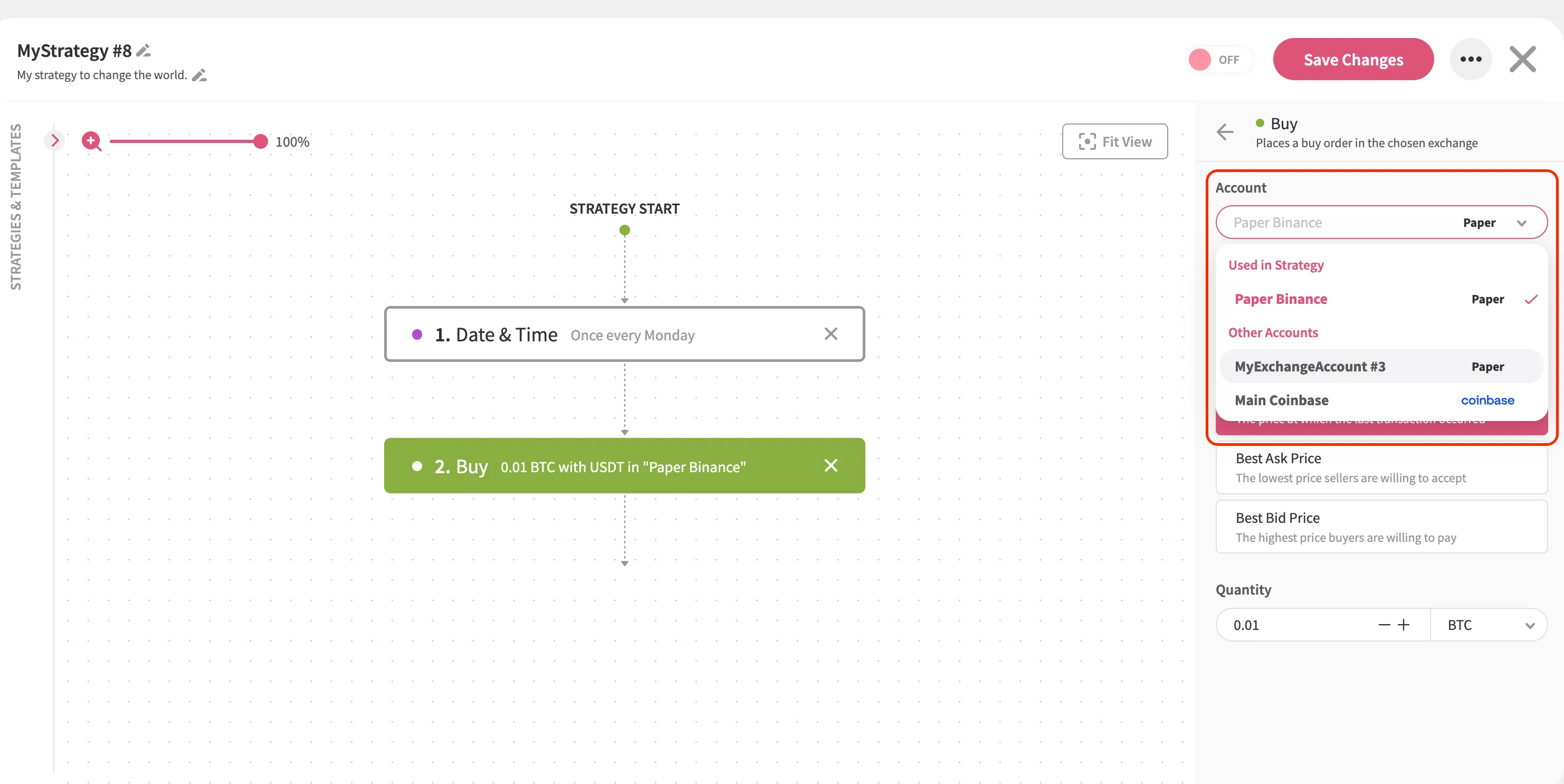

8. Use This Paper Exchange Account in Your Strategies

Your new paper exchange account is now ready! You can start using it in the strategy editor to test your trading strategies safely and effectively.