Understanding the core components and limitations of Jellydator’s automated strategies plays a crucial role in achieving better and more profitable outcomes while avoiding costly mistakes. In this article, we’ll explore the key features that can enhance your approach to strategy creation and take your trading to the next level.

TLDR:

- Strategies are made of steps that mirror the actions you’d perform yourself.

- Steps have a fixed sequence that is determined by their sequence numbers.

- You may combine multiple steps that analyze many different data sources like market charts, Google Trends, crypto ETFs.

- The Paths step allows you to create branching strategies with different outcomes.

- The AND/OR operator steps let you customize the execution flow of your strategies.

Strategy Action Steps

The Jellydator strategy editor is designed to help you transform the actions you perform manually into clear and easily understood automated processes, also known as strategies. Typically, a strategy is designed to serve a single purpose, such as buying Bitcoin when the market shows oversold conditions and selling it when it becomes overbought. This focused approach keeps strategies predictable and easy to manage.

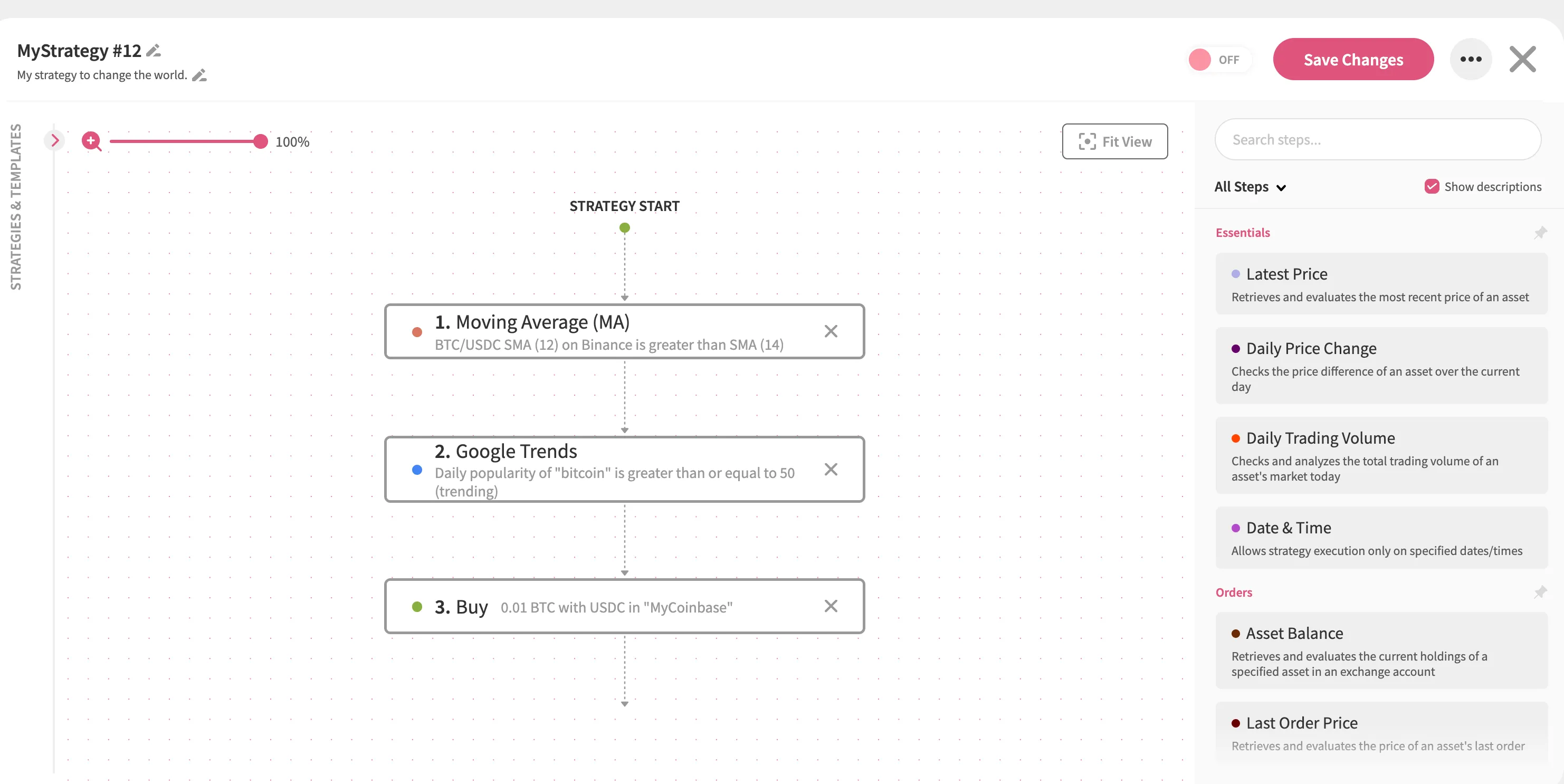

Each strategy consists of multiple steps that represent the same previously-mentioned human actions. These steps are executed sequentially in the order you define, mirroring the workflow you’d follow yourself. For example, if you want to analyze the latest Simple Moving Average (SMA) to identify Bitcoin market trends, check Google search trends for the keyword “bitcoin,” and finally place a buy order for 0.001 BTC, you would normally switch between multiple apps or browser tabs to gather this information before executing the trade. With Jellydator, this entire process is streamlined into a single three-step strategy:

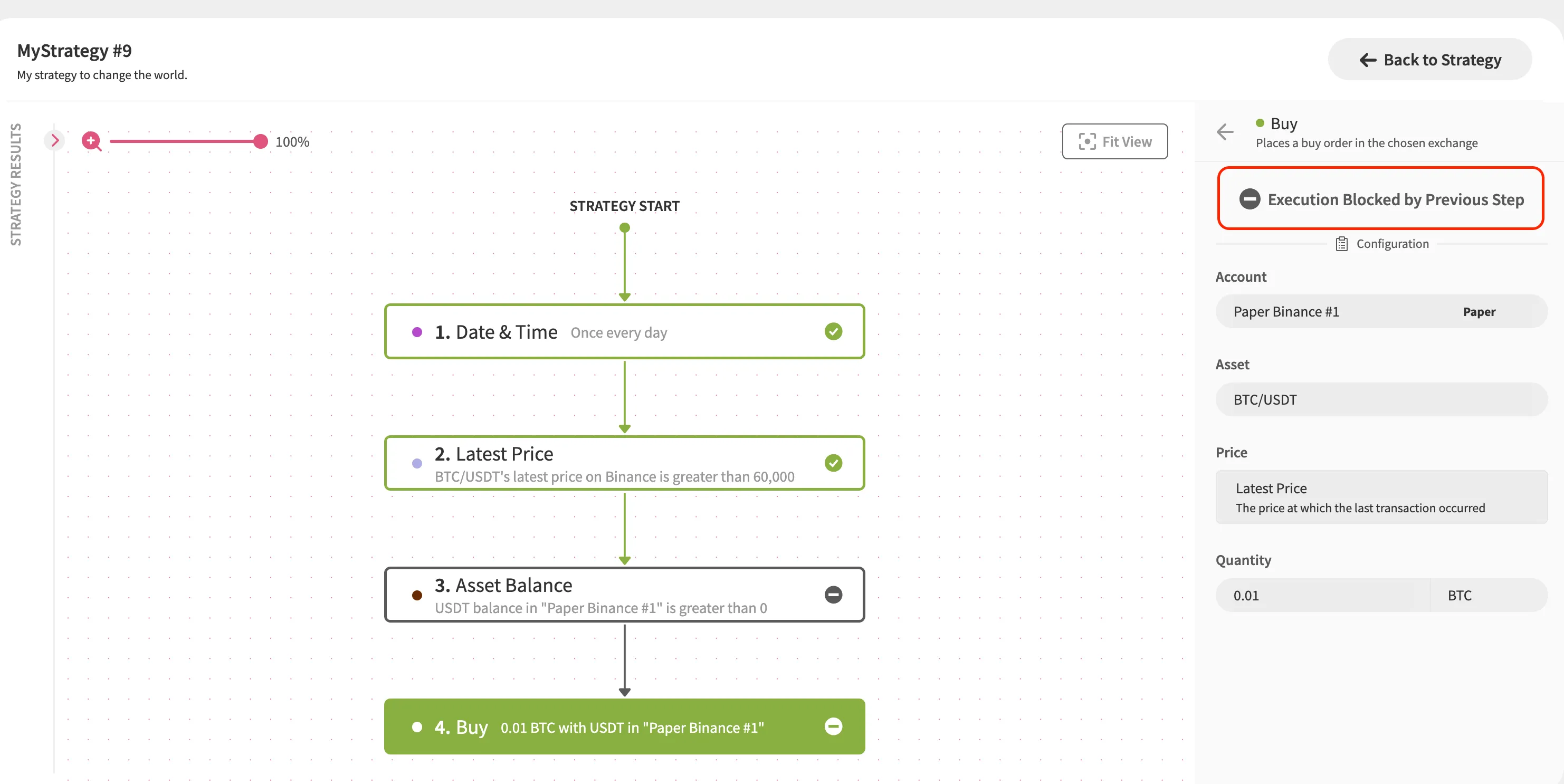

The numbers displayed on the left side of each step indicate their execution sequence within the strategy. It’s important to understand that no step can execute before the one preceding it, and that whenever a step’s data doesn’t meet its conditions, all the subsequent steps are blocked. This allows the Jellydator engine to ensure that, for instance, a Buy step isn’t executed if a preceding Asset Balance step fails to meet its conditions.

Step Categories

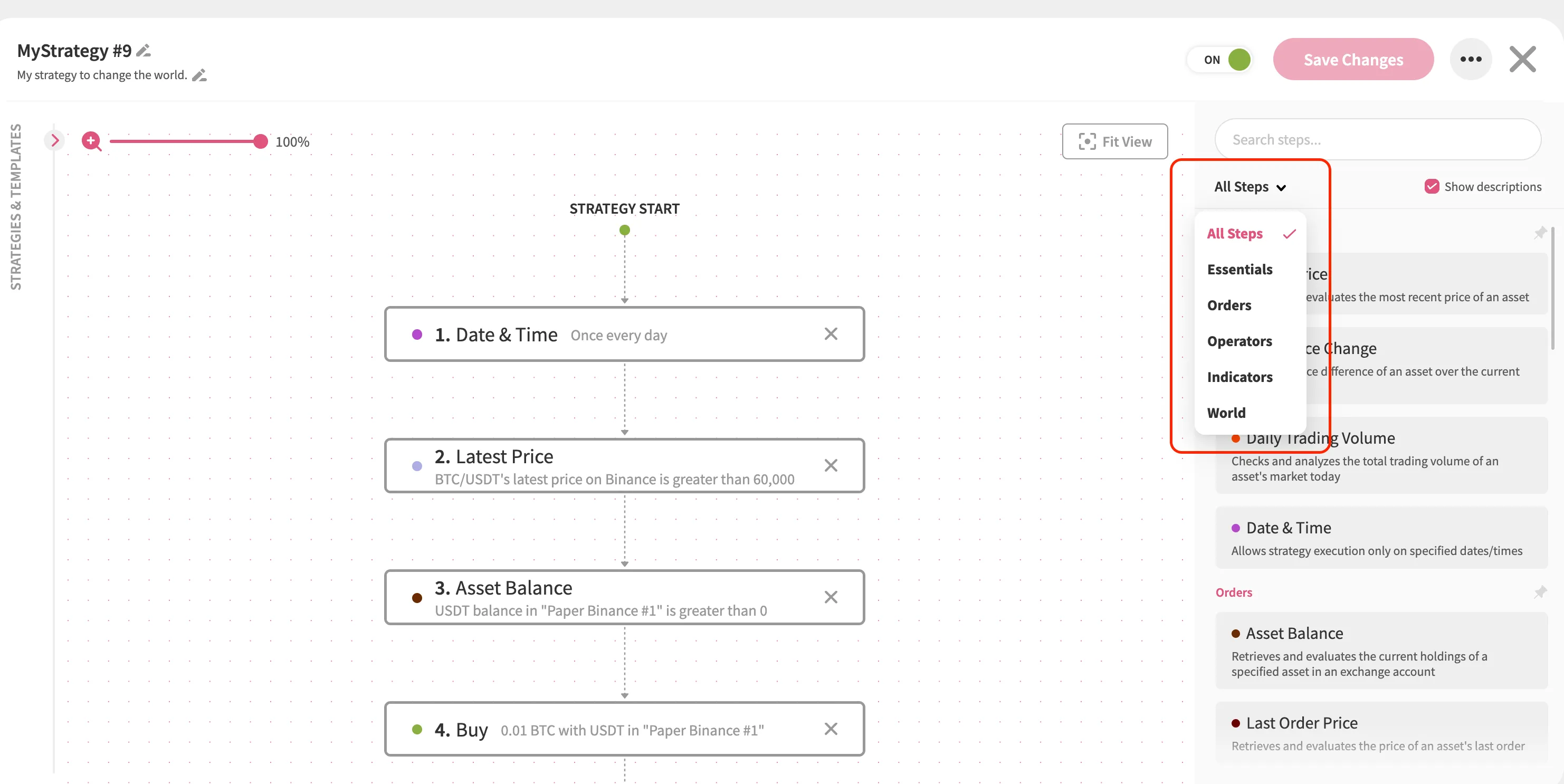

The Jellydator editor offers an ever-growing selection of steps that let you analyze and track various aspects of your target market. This flexibility allows you to combine simple technical analysis tools like SMA, RSI, or ROC, with more advanced data like Google Trends, regional inflation rates, or crypto ETFs. All of them are accessible in a unified location on the right side of your editor:

To make finding the right steps easier, we’ve grouped them into five categories:

- Essentials - includes frequently used steps like Latest Price and Daily Price Change.

- Orders - focuses on order and account-related steps such as Buy, Sell, and Asset Balance.

- Operators - provides specialized steps for modifying or splitting the execution flow of your strategy, ideal for advanced use cases.

- Indicators - features technical analysis tools like EMA, RSI, and ROC, commonly used in chart analysis.

- World - offers alternative data steps to monitor metrics like market sentiment, search engine trends, inflation rates, ETFs, and more.

Gone are the days of juggling multiple tabs to analyze different market data sources. With Jellydator’s editor, you can seamlessly integrate all these tools into one convenient workspace to uncover meaningful correlations and build smarter strategies.

Strategy Branching

Sometimes, you may want to create a strategy that handles two different scenarios, such as:

- Buying BTC if it’s trending.

- Selling BTC if it’s not trending.

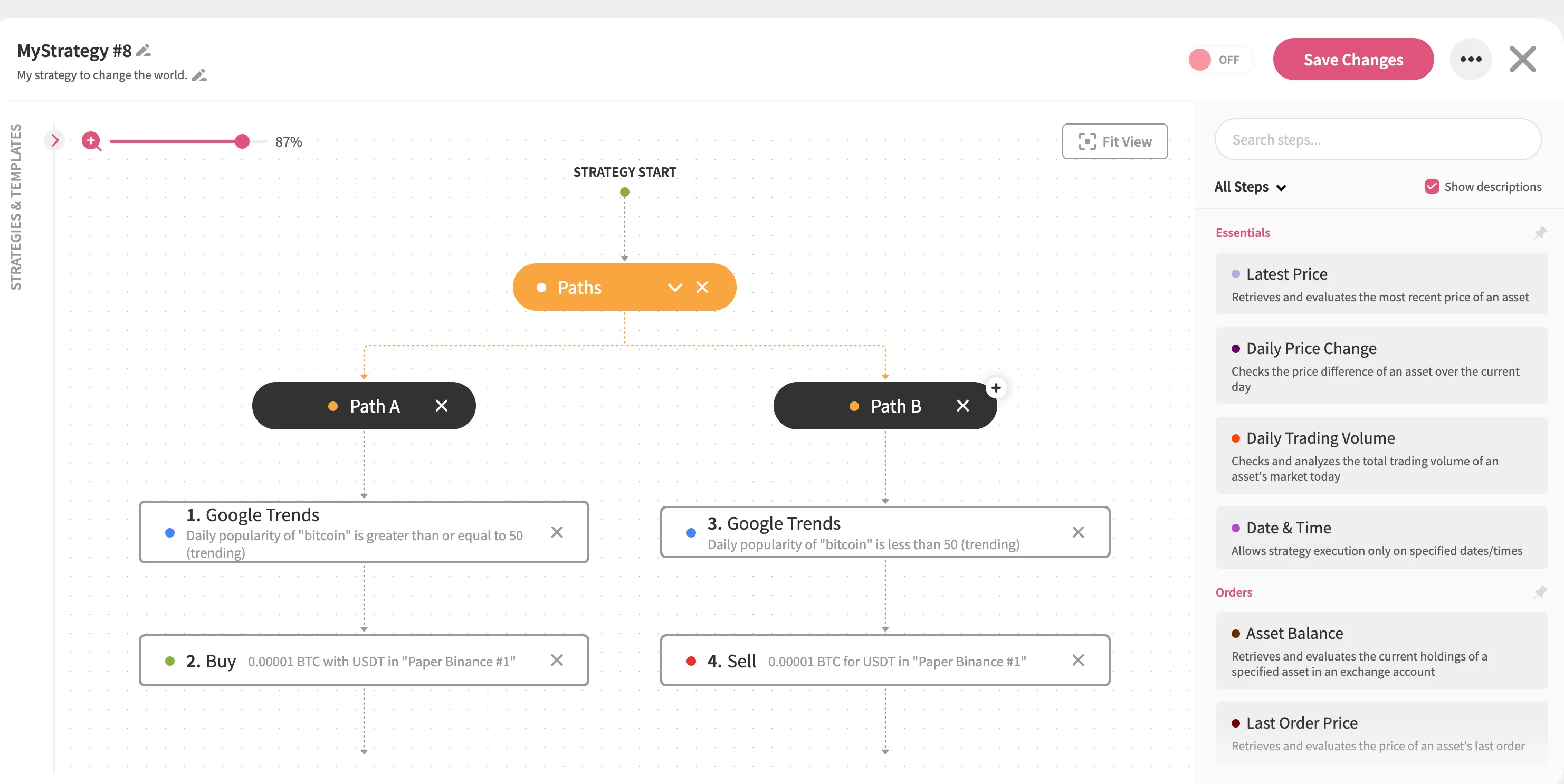

This can be easily accomplished with an operator step called Paths. The Paths step allows you to split your strategy into two or more execution branches, commonly referred to as paths. The image below demonstrates how Paths can be used to set up separate buy and sell branches for BTC:

A key point to remember is that all paths are executed independently, regardless of the execution status of neighboring paths. This allows you to have multiple conditions and outcomes within the same strategy (executed from left to right, following the same step numbering system). However, to avoid conflicting actions—such as placing both a buy and sell order simultaneously—ensure that each path includes steps with additional conditions that control the execution flow (just like in the illustration above).

Modifying Strategy Flow

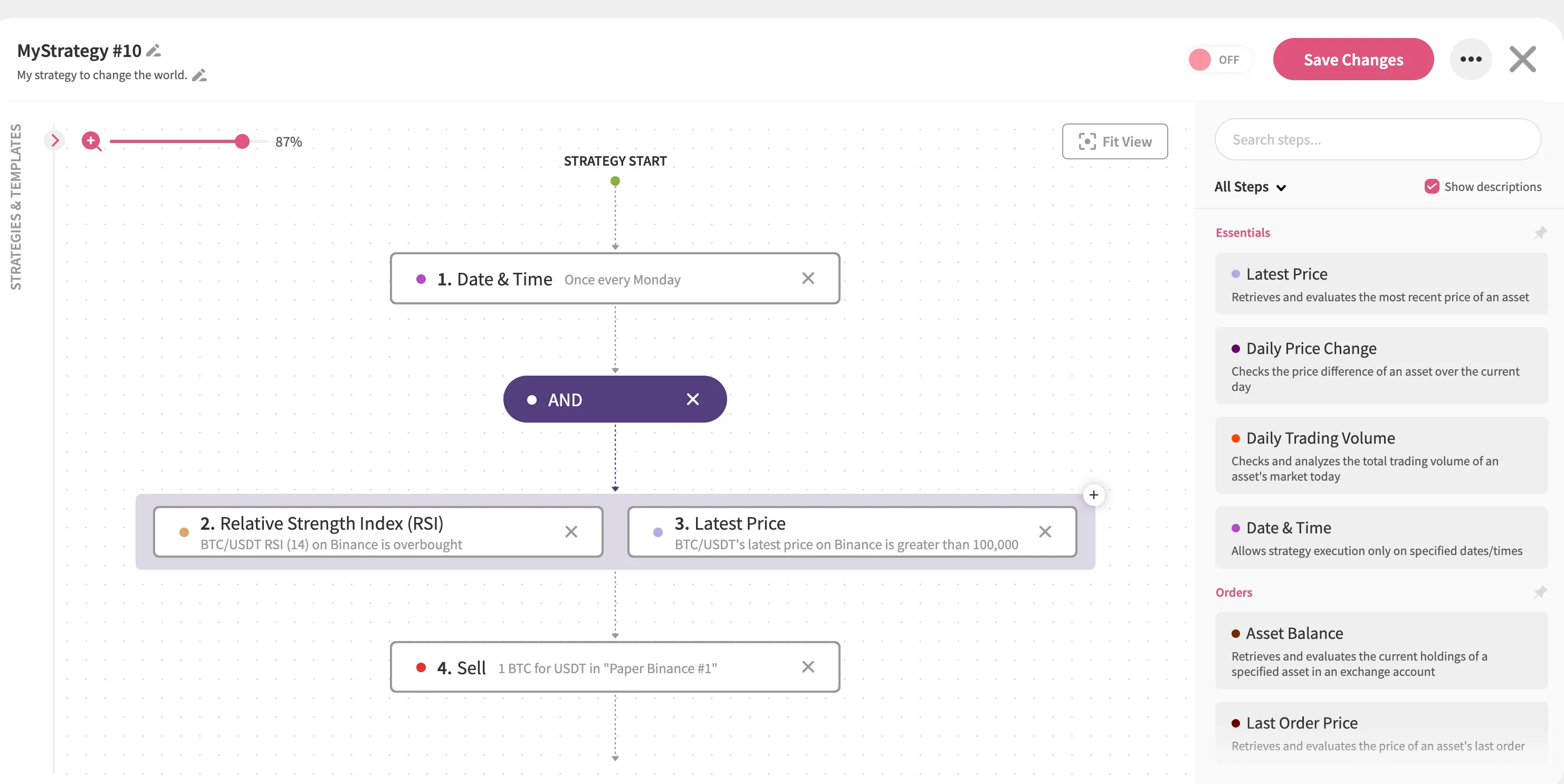

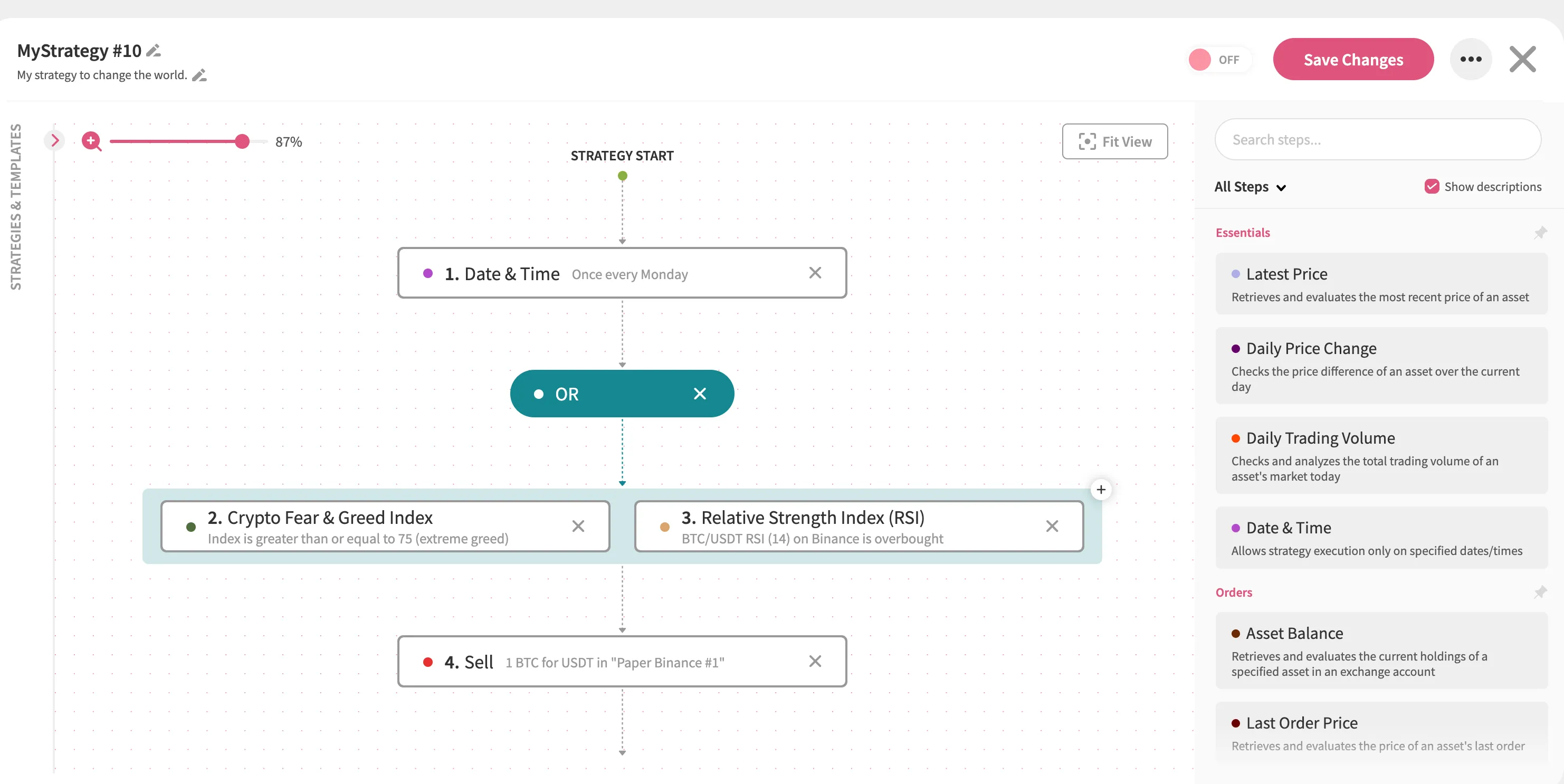

As explained in Strategy Action Steps, strategy steps are typically executed one after another, with each step blocking the next if its conditions aren’t met. However, Jellydator offers two special operator steps that allow selected steps to run side-by-side, as if they were a single step. These operators are:

- AND - allows the chosen steps to execute simultaneously but halts the strategy if even one step within the AND operator fails to meet its conditions.

- OR - also allows the chosen steps to execute simultaneously but lets the strategy proceed if at least one step within the OR operator succeeds.

By incorporating AND/OR operators into your strategy, you can customize how the Jellydator engine handles step execution and determines the optimal moment to move forward within your strategy flow. This flexibility ensures your strategies align perfectly with your trading goals.

Conclusion

Jellydator strategies are meant to work as an extension of you, automating the market data gathering and analysis tasks you’d typically handle manually. By understanding the fundamentals of strategy execution and data processing discussed in this article, you’ll be well-equipped to begin developing your own Jellydator strategies.