If you’ve ever wondered how search trends can help you spot shifts in the crypto market, you’re in the right place. In our previous blog post on Google Trends and crypto FOMO, we explored how this tool can reveal patterns in search behavior that often signal changes in cryptocurrency prices. We even showed how to build a trading strategy that combines Google Trends with technical indicators like RSI. Today, we’ll take it a step further and show you how to set up an automated strategy that sends you Telegram notifications whenever there’s a significant change in Bitcoin-related search trends.

Let’s quickly recap why Google Trends matters in crypto trading:

- Google Trends reveals patterns in search behavior that can signal upcoming changes in cryptocurrency prices.

- Bitcoin usually reacts quickly to search interest (often with 1-day lag), while Ethereum tends to respond more gradually (with up to 7-day lag); Dogecoin shows a notable correlation between search trends and price movements, driven by its meme-driven nature and sensitivity to public sentiment.

- Smaller cryptocurrencies and meme coins are highly sensitive to search trends, making Google Trends particularly useful for identifying opportunities in altcoin trading.

For this tutorial, we’ll focus on tracking the keyword “Bitcoin,” but you can easily swap it with other terms like “Ethereum,” “Binance,” or even specific altcoins. We’ll use Telegram notifications so you can get updates right on your phone. If you haven’t linked your Telegram account to Jellydator yet, it only takes a few quick steps, just follow our guide here. And if you prefer a different notification method, you can substitute the Telegram steps with your favorite option.

Investigating the Trends

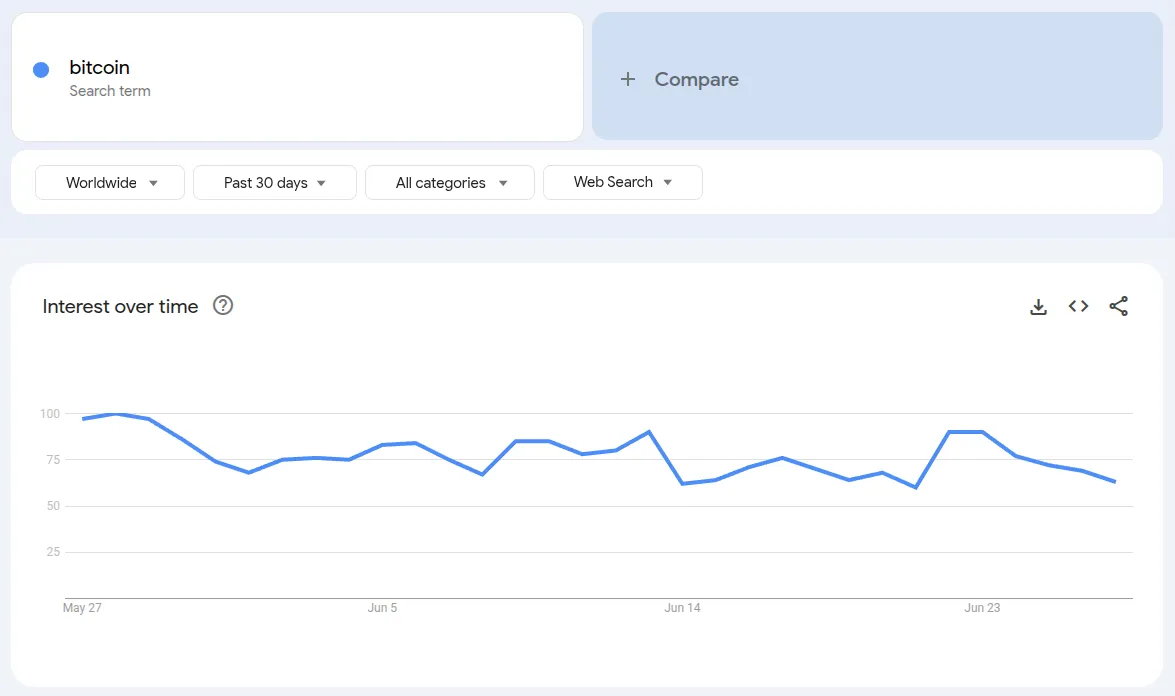

First, before we automate the search tracking and notification sending, we need to understand how Google Trends data and market information correlate. Let’s use the last month as an example (May 27, 2025, to June 27, 2025).

- At the end of May, Google Trends recorded an interest score of 100 (the highest possible). As this interest faded, Bitcoin’s price started to drop gradually.

- On June 5th, the price took a sharp dive, but search interest actually began to climb.

- June 21st brought another price dip, which was quickly followed by a 10% price jump and a 50% surge in search interest.

For the rest of the month, both price and search interest stayed fairly steady, with Google Trends fluctuating by just 1–7 points most days. To avoid constant notifications about minor changes, we’ll set our system to alert us only when the search interest changes by more than 8 points. Keep in mind, a spike in search interest doesn’t always mean the market is about to turn bullish. Instead, it usually signals increased volatility. These notifications will help us stay alert and ready for possible price swings, rather than signaling a clear market direction.

Using this information, we can start developing our automated strategy so that we get notified whenever Bitcoin’s price shows signs of increased volatility.

How to Implement This in Jellydator

With Jellydator, tracking Google Trends is straightforward and can be configured in a few simple steps. If you would like to skip the manual setup, you can use a pre-made template with this link.

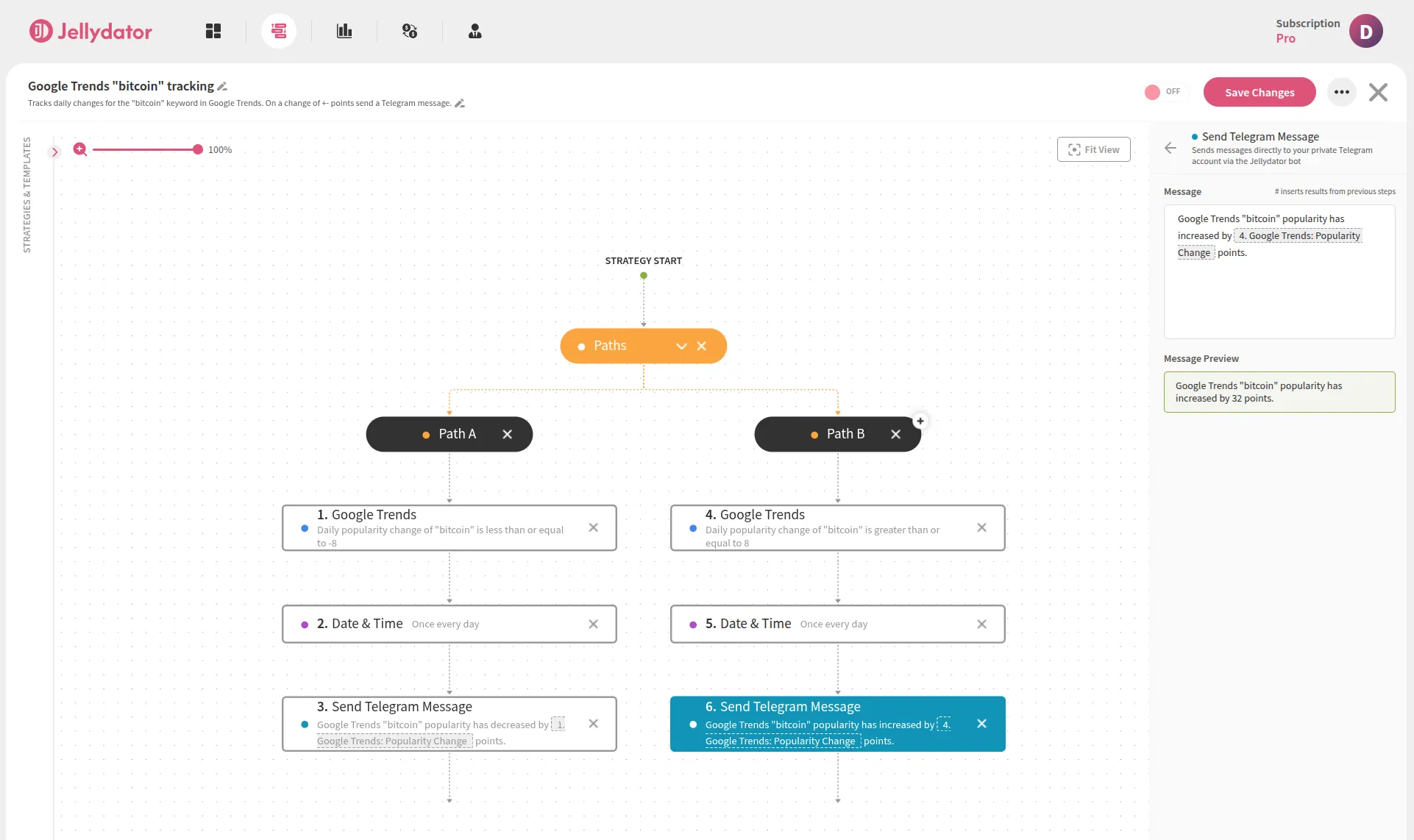

- Start by creating two strategy branches (also called Paths): one for when search popularity goes up, and another for when it goes down.

- Add a Google Trends step to each branch and select “bitcoin” as your keyword. Choose the “daily” time period and set it to track the “popularity change.” For the conditions, set one branch to trigger when the change is greater than 8 points, and the other when it’s less than -8 points.

- Add Date & Time steps to make sure you only get one notification per day, so your phone doesn’t get flooded with messages.

- Add Send Telegram Message steps to each branch. These will send you a notification with details about the change, using placeholders to include the exact numbers.

Conclusion

Automating the tracking of Google Trends data for keywords like “bitcoin” and connecting it with Telegram notifications gives crypto traders a practical way to stay on top of market sentiment and spot potential volatility early. As we’ve seen, changes in search interest often come just before or at the same time as big price moves, especially with assets like Bitcoin, altcoins, and meme coins that tend to react quickly. Still, it’s important to remember that higher search interest usually signals more volatility, not necessarily a clear bullish or bearish trend.

By filtering out minor fluctuations and focusing only on significant shifts in Google Trends data, you can reduce noise and get alerts only when something important is happening. Platforms like Jellydator make this process simple, letting you automate crypto-related notifications and customize your strategy for your favorite assets.