Ever wondered what it actually takes to build a trading bot? If you’ve searched for advice online, you’ve probably seen it all: some say you should code your own bot for total freedom, while others recommend sticking to the simple, built-in tools on your favorite exchange. Maybe you’ve even tried a third-party platform, only to find yourself tangled in confusing rules or wishing you could use more data than just price charts.

The reality is, every approach has its own set of trade-offs. Coding your own bot gives you flexibility, but it also means dealing with programming, servers, and endless troubleshooting. Exchange-provided bots are easy to set up, but they’re often basic and limited. Third-party bots offer more features, yet still box you in when it comes to unique data sources or custom strategies. There are even platforms that aim to combine the best of all these worlds.

In this article, we’ll break down the pros and cons of each of these four options to help you decide which approach fits your needs best.

Coding It Yourself

Many in the automated trading world suggest building your own trading bot. The main reason is simple: you get total freedom. You can design your bot to follow any strategy, use any data, and avoid the restrictions that come with most platforms. If you want to trade using your own unique metrics or calculations, coding your own bot seems like the obvious path.

But reality sets in quickly. You need to learn a programming language like C++, Rust, or Go. You must test your code and strategies, and set up a cloud server if you want your bot to run around the clock. Server costs alone can range from tens to hundreds of dollars per month. You also need to manage connections to exchanges, handle orders, and build backup systems in case something fails at the worst moment. If you want to use extra market data—like social media sentiment or Google Trends—you’ll need to buy access from each provider, which can push your costs into the hundreds or even thousands of dollars. And since you built the bot, you’ll be the one fixing bugs and making improvements. There’s no handy interface; it’s all code.

To help you decide if this approach is right for you, let’s look at the main pros and cons:

Pros:

- Complete freedom to create your own trading algorithms.

- No unnecessary features or configurations you don’t need.

- Full trust in your code, since you control every detail.

Cons:

- You must know how to code and test in at least one programming language.

- You’re responsible for server costs, which can add up quickly.

- You need to maintain your server and handle outages yourself.

- You must manage exchange connections and technical issues.

- Integrating extra data sources (like social media sentiment or Google Trends) means buying separate licenses, which can get expensive.

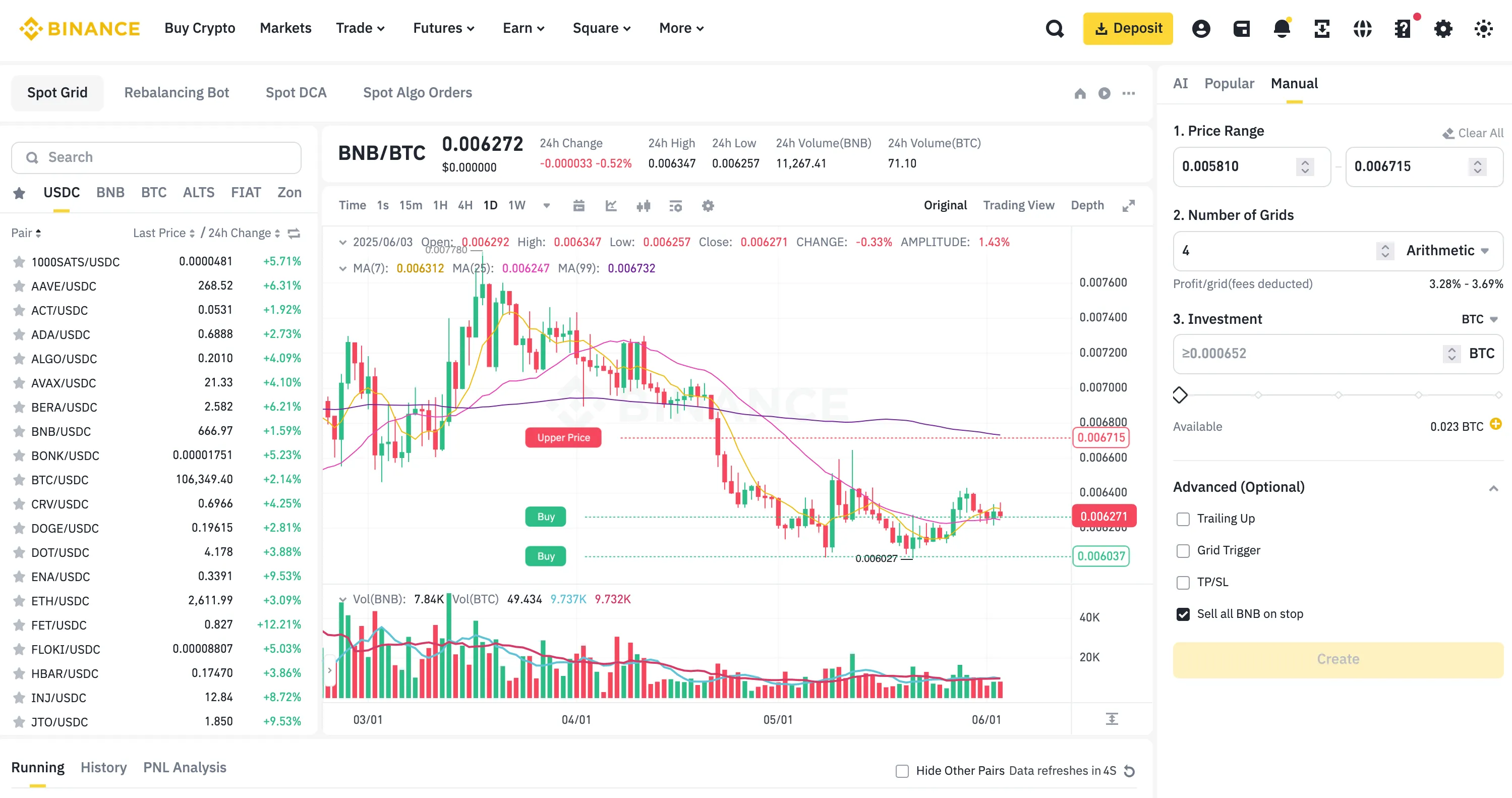

Exchange-Provided Bots

At the other end of the spectrum are trading bots built into some crypto exchanges. Not every exchange offers these, but platforms like Binance let you set up simple automated buy or sell orders based on price or profit targets.

If you only need basic automation and don’t care about extra indicators, these bots are a great fit. They’re easy to set up and don’t require any extra servers or maintenance. Everything happens right in your exchange account, giving you complete peace of mind.

Before you decide if exchange-provided bots fit your needs, here are the main pros and cons:

Pros:

- Easy to set up.

- No extra server or maintenance costs.

- Fully integrated within the exchange.

Cons:

- Only a few exchanges offer this feature.

- Limited options for customization.

- Can’t use technical indicators.

- No access to social media sentiment, Google Trends, or other unique data.

- Can’t interact with other exchanges for things like arbitrage.

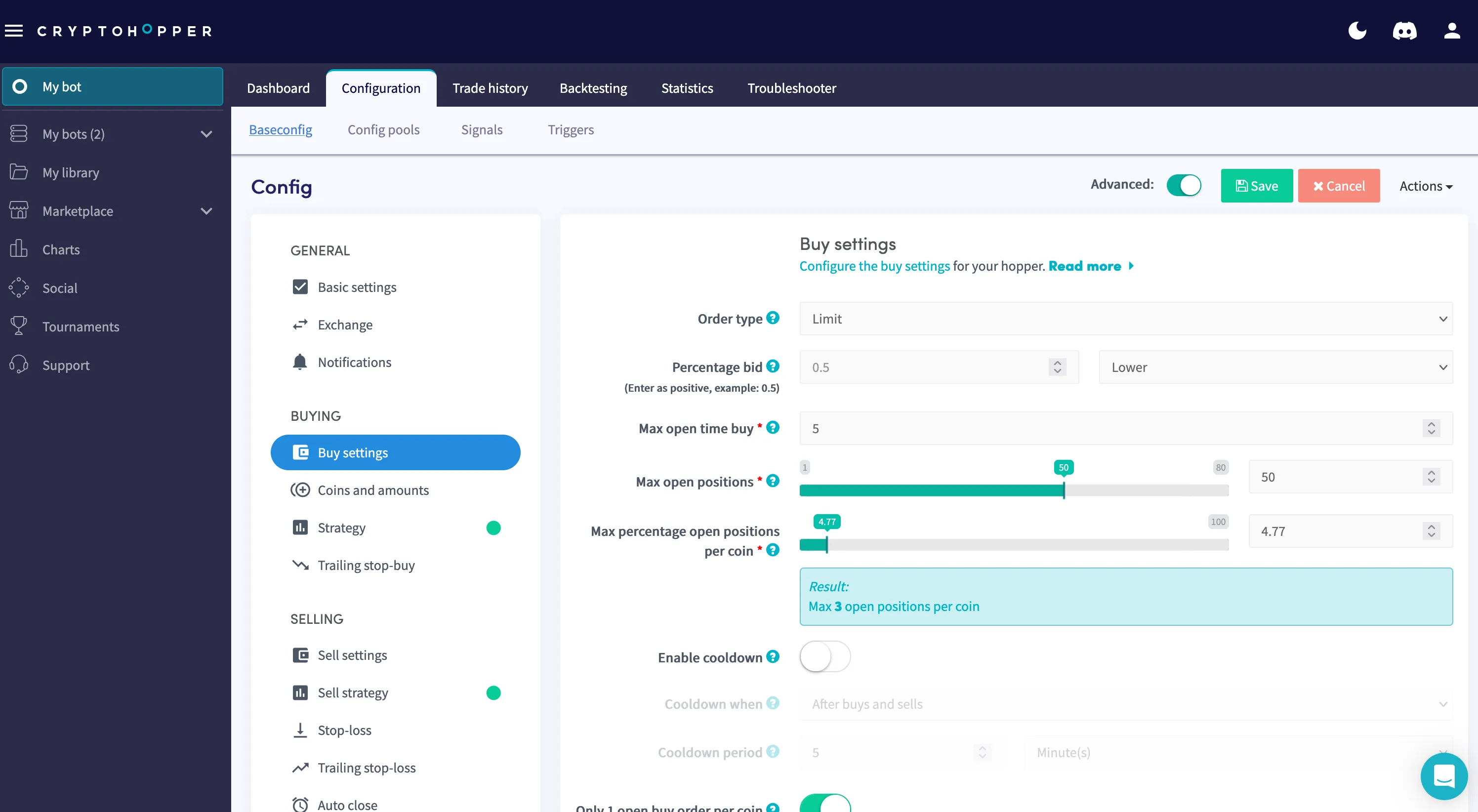

Third-Party Trading Bots

Platforms like CryptoHopper, 3Commas, Bitsgap, and Cornix offer another option. These services provide pre-built bots with more configuration options than most exchanges. You can use them on exchanges that don’t have built-in bots, and they usually come with dashboards to track your performance.

However, these platforms set many of their own rules and configurations. You’ll need to adjust your strategies to fit their systems, and you can’t always customize everything. Most third-party bots focus on price and technical indicators, so you won’t be able to use data like social media sentiment or Google Trends either.

Again, to make your choice easier, here’s a quick look at the pros and cons:

Pros:

- Work with exchanges that don’t have their own bots.

- More configuration options than when using exchange-provided bots.

- Offer dashboards for tracking performance.

- No extra server or maintenance costs.

Cons:

- Most bots are pre-built and similar to exchange bots.

- Platform rules and algorithm configurations don’t offer much room for customization.

- You have to learn each platform’s way of doing things.

- You can’t use extra market data like social media sentiment, Google Trends, or ETF metrics, so your bot relies only on price charts.

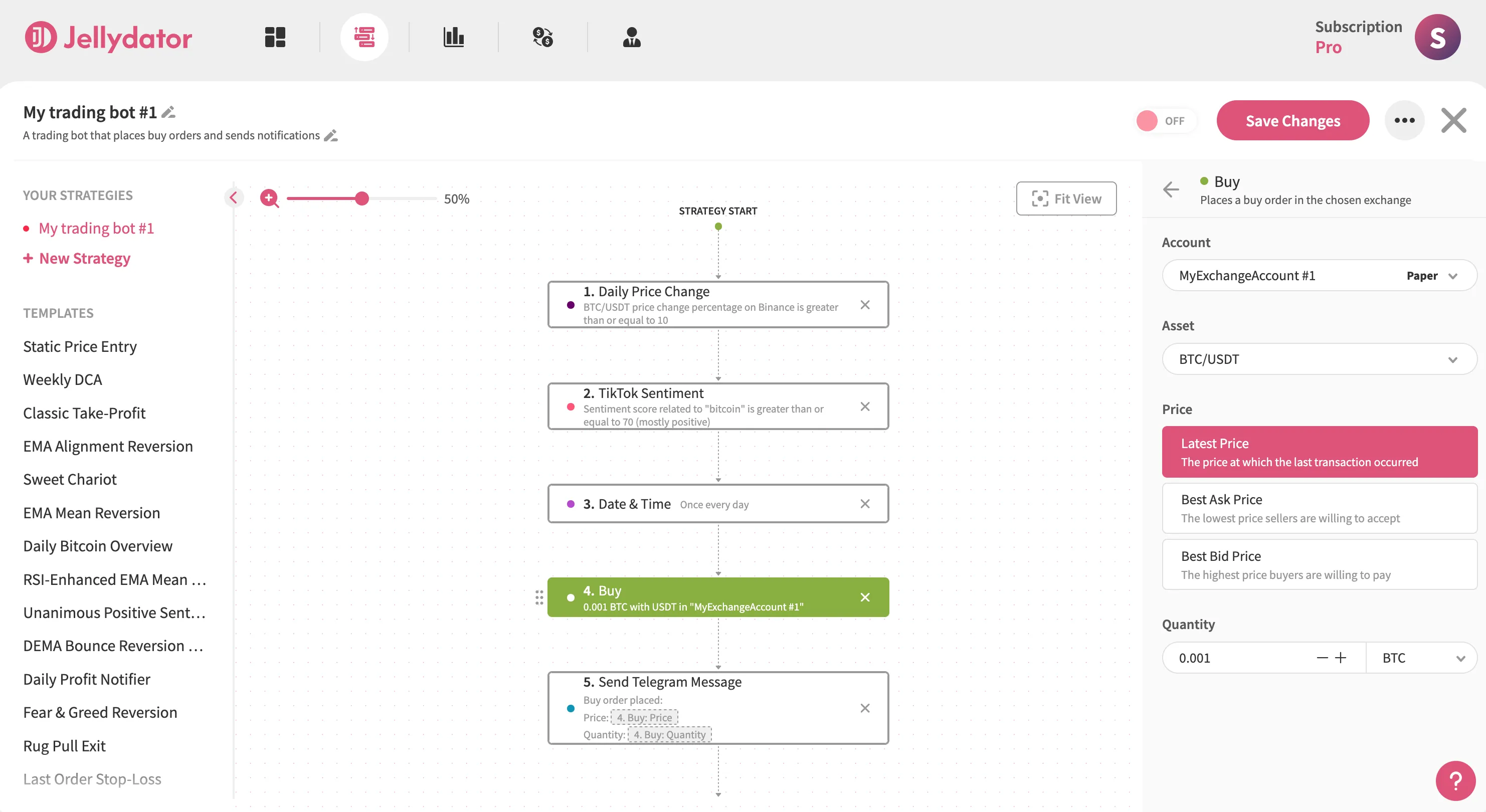

Jellydator

Jellydator offers a fresh take on automated trading platforms. It is not limited to pre-built bots with only a handful of features, nor does it require you to write scripts from scratch. Instead, Jellydator combines the strengths of both worlds by giving you a visual strategy editor. With this editor, you can build trading bots for simple tasks like price checks and order placements, or create more advanced strategies that perform social media sentiment tracking, technical analysis, and monitoring of multiple exchanges simultaneously. All of this is done by dragging and dropping logic blocks, making the setup process straightforward and flexible.

If you’re considering Jellydator, here’s an overview of its key features and potential limitations:

Pros:

- Analyze a wide range of data sources—price, sentiment, trends, inflation, ETFs, and more—without extra costs.

- No server or maintenance worries.

- Plenty of room for custom strategies.

- Use pre-built templates for faster setup.

- Trade on multiple exchanges in one bot.

- Access all your bot, portfolio, and market metrics in one place.

Cons:

- Some very advanced or unique strategies may still require custom code.

- You can’t see or edit the underlying code; everything is managed through visual blocks.

Which Trading Bot Option Should You Choose?

If you need a highly specialized trading bot that reacts in milliseconds and manages large sums, coding your own solution may be the way to go. This approach gives you complete control, but also requires technical skills, time, and a higher budget for servers and data.

For most users, Jellydator offers the perfect balance. It gives you the freedom to build unique trading bots and tap into a wide variety of data sources—including social media sentiment, Google Trends, crypto fear and greed, fiat inflation—without the hassle of coding or extra costs. You can start with simple strategies and add complexity as you become more comfortable, all within a platform that’s easy to navigate. If you want to automate your trading strategies without dealing with technical headaches, Jellydator is a smart and practical choice.