In our previous blog posts, we explained what DCA is and built a custom schedule. In this article, we will explore how the DCA strategy can be enhanced by incorporating technical indicators like Crypto Fear & Greed, Relative Strength Index (RSI), and sentiment-based triggers.

Combining Crypto Fear & Greed Index with DCA

The Crypto Fear & Greed Index is a popular tool among retail investors because it reflects the overall sentiment of the crypto market. While the strength of dollar-cost averaging (DCA) is that it typically ignores short-term market sentiment, there are ways to enhance your strategy by leveraging this index. By combining the Crypto Fear & Greed Index with DCA, you can choose to increase your positions when the market is experiencing fear, which often coincides with lower prices.

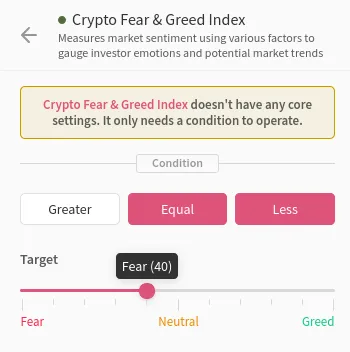

To implement this, you can add the built-in Crypto Fear & Greed Index step

before your Date & Time step, ensuring that purchases only occur when the market

is in a state of fear. Configuration is straightforward: use the slider to set

your desired index threshold and select the appropriate condition operators

(such as “equal to” or “less than”) to target periods of market fear.

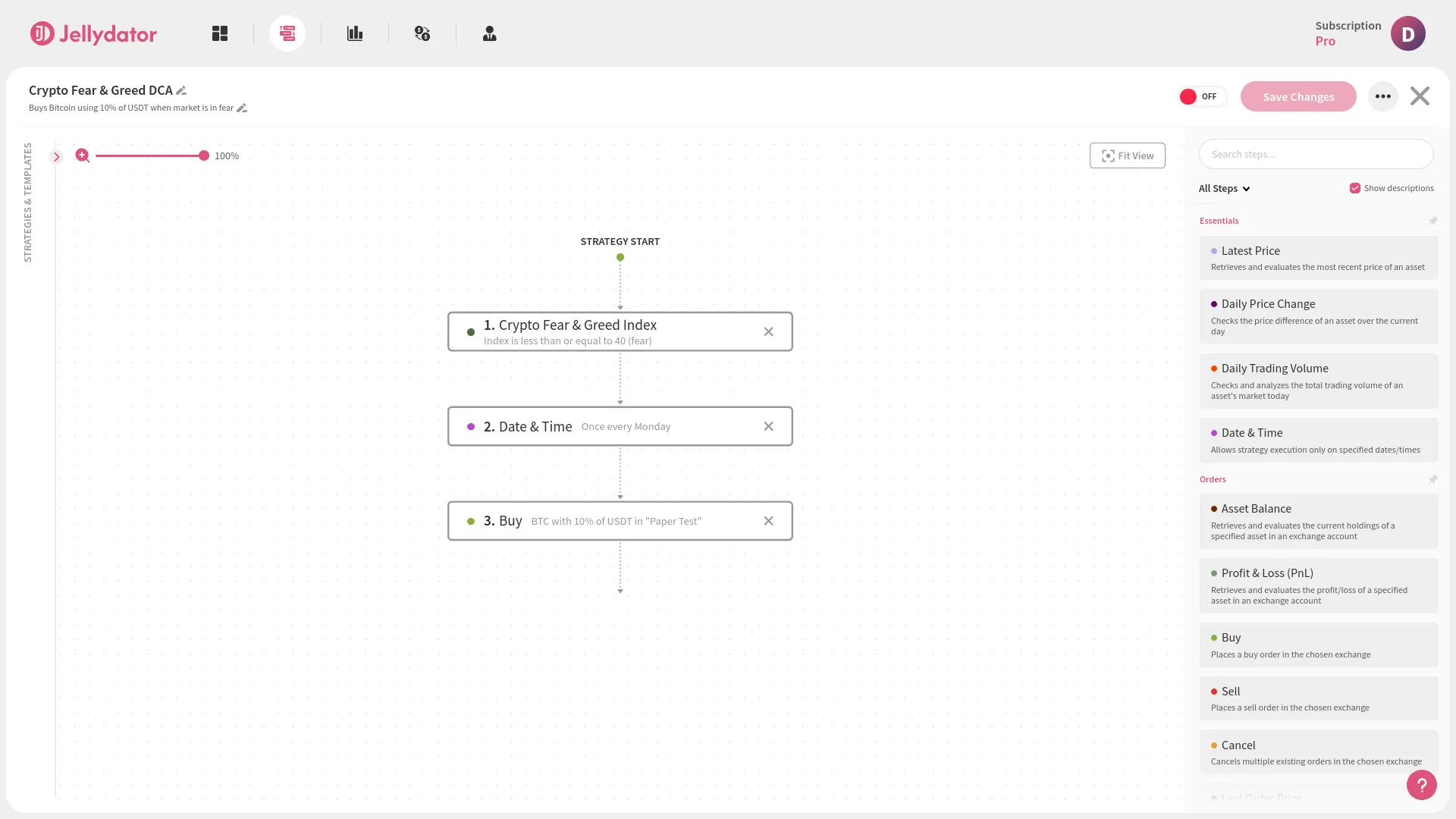

There is nothing more to it, we add the Buy step and we have a strategy that buys

our asset based on the schedule and Crypto Fear & Greed index. This strategy allows

us to continue buying assets during periods of market fear and to wait out during

times of market greed.

Adding Sentiment Analysis and Technical Indicators

Just as we leveraged the Crypto Fear & Greed Index to our advantage, we can apply the same approach with a variety of other technical indicators and social sentiment tools. The platform offers a wide selection of technical indicators, including Aroon, Bollinger Bands, RSI, and Moving Averages, among others. For social tracking, you can utilize tools such as Google Trends, YouTube Sentiment, X (Twitter) Sentiment and so on.

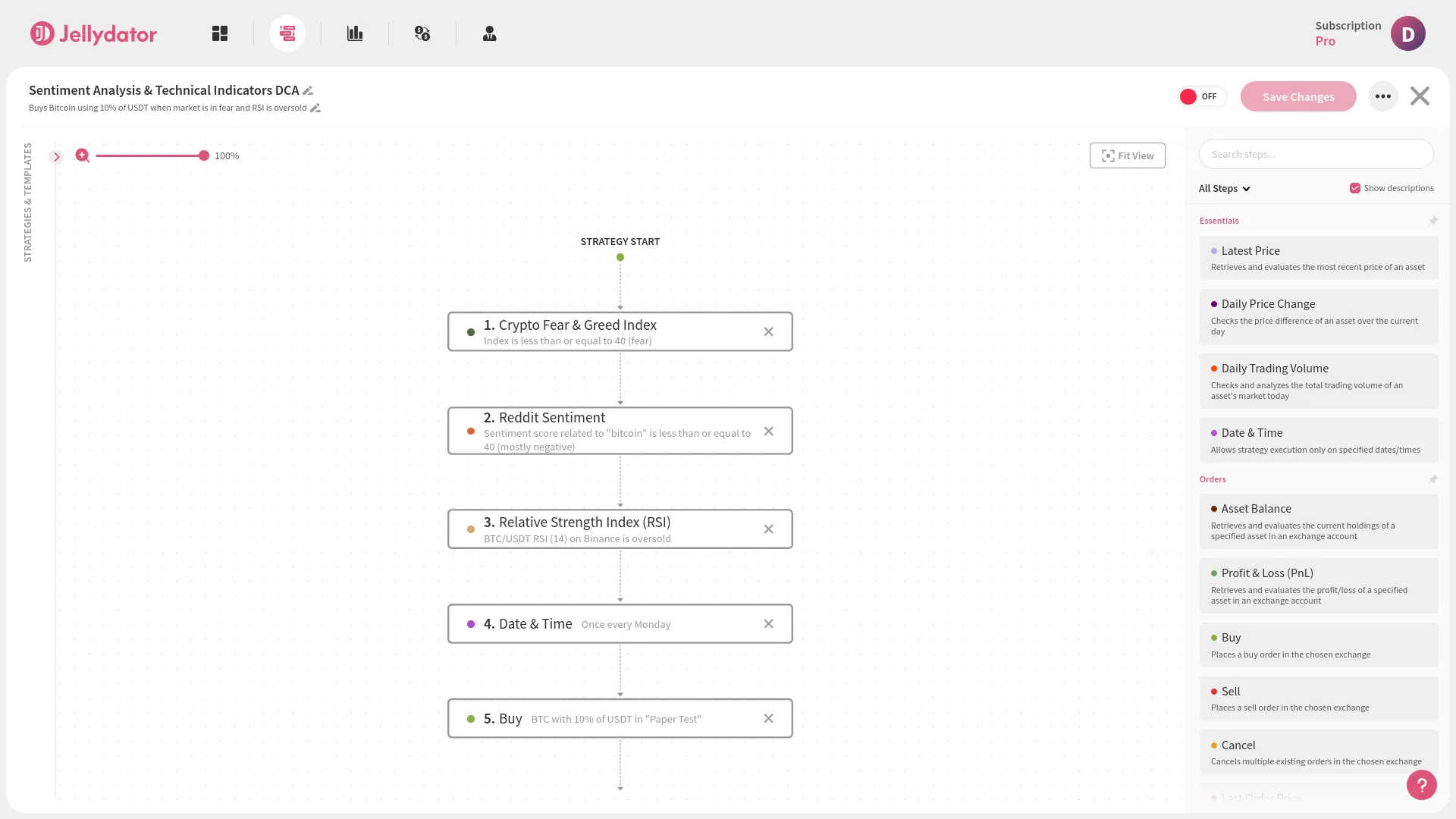

Building on the Crypto Fear & Greed Index DCA setup, we can further enhance our strategy by incorporating an oversold RSI condition and Reddit Sentiment analysis. These additional steps serve as confirmations of market fear, helping to refine entry points and improve the effectiveness of your DCA strategy.

First of all, at the beginning of the strategy drag-and-drop

Relative Strength Index (RSI) and Reddit Sentiment steps to incorporate them into strategy.

For RSI you will need to select the exchange, asset and interval for which the index will be calculated. Specify the condition target and use condition operators (such as “equal to” or “less than”) to target periods of an oversold market.

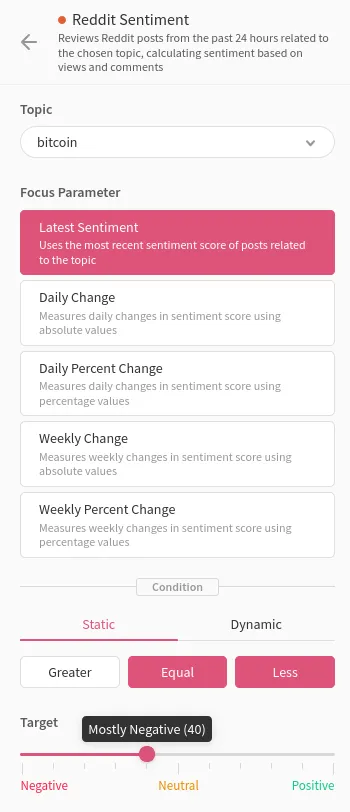

For Reddit Sentiment, the flow is the same. We select a topic for which we will measure the sentiment (use “bitcoin” or “cryptocurrencies”), set the focus parameter and condition to target a negative market sentiment.

Once you’re done, the final strategy should look something like this. This strategy will ensure that DCA is performed only when the asset is oversold, the market is in fear and the Reddit sentiment is negative.

Conclusion

Dollar-cost averaging (DCA) remains a reliable and disciplined strategy for cryptocurrency investors seeking to grow their portfolios while managing risk. By moving beyond the rigid, built-in recurring buy features offered by most exchanges, investors can unlock far greater flexibility and control. Platforms like Jellydator empower users to Incorporate technical indicators and sentiment analysis to refine entry points and respond to market signals. Custom enhancements allow investors to tailor their DCA approach, making it smarter and more responsive to both personal objectives and market dynamics. While DCA’s core strength lies in its simplicity and ability to reduce the impact of volatility, leveraging advanced tools ensures that your strategy can adapt and thrive in the ever-changing crypto landscape. For those looking to go beyond the basics, exploring automated platforms like Jellydator offers a compelling path to more effective and personalized investing.